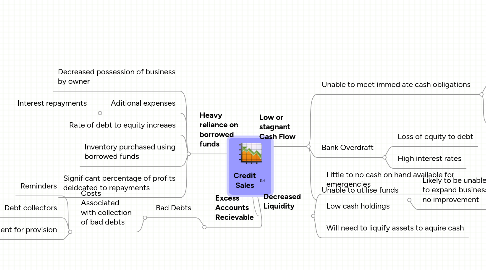

Credit Sales

by Casey Flint

1. Heavy reliance on borrowed funds

1.1. Decreased possession of business by owner

1.2. Aditional expenses

1.2.1. Interest repayments

1.3. Rate of debt to equity increaes

1.4. Inventory purchased using borrowed funds

1.5. Significant percentage of profits deidcated to repayments

2. Excess Accounts Recievable

2.1. Bad Debts

2.1.1. Costs Associated with collection of bad debts

2.1.1.1. Reminders

2.1.1.2. Debt collectors

2.1.1.3. Requirement for provision

3. Low or stagnant Cash Flow

3.1. Unable to meet immediate cash obligations

3.1.1. Leads to dependency on borrowed funds

3.1.2. Damages reputation of business

3.2. Bank Overdraft

3.2.1. Loss of equity to debt

3.2.2. High interest rates

3.3. Unable to utilise funds

3.3.1. Likely to be unable to expand business: no improvement