1. 3. New Consumers, New Retail

1.1. Isabel Cantista

1.1.1. Managing Partner

1.1.2. Fast Forward Innovation

1.1.3. Portugal

1.2. FASHION RETAIL & CONSUMER BEHAVIOUR

1.3. example vente-privee.com

1.3.1. luxury products

1.3.2. registered consumer

1.3.3. retailing of a lifestyle

1.3.3.1. wine

1.3.3.2. electronic devices

1.3.4. started in 2011

1.3.5. > 15 mln users

1.3.6. 6100 new register

1.3.7. 150k products a day

1.3.8. sending 74k packages per day

1.3.9. demographics

1.3.9.1. 503 mln people

1.4. Brasil

1.4.1. young people

1.4.2. decide via the web what to buy

1.4.3. New node

1.5. pop-up stores

1.5.1. temporary stores

1.5.1.1. In 2005 in Eu

1.5.1.2. ass. for temp stores

1.5.2. such as

1.5.2.1. LV

1.5.2.2. Nike

1.5.3. offer limited/ exclusive

1.5.4. test market

1.5.5. not huge investment

1.5.6. offer experience

1.5.7. exhibition/ event

1.5.8. examples

1.5.8.1. store becomes a black box

1.6. C&A convergence means

1.6.1. shops

1.6.2. shop online

1.7. operational terms

1.7.1. see in store

1.7.1.1. life catelogue

1.7.2. buy online

1.7.3. no

1.7.3.1. stocks

1.7.3.2. mark down

1.8. what does cosumer want

1.8.1. time

1.8.1.1. not much time

1.8.1.2. take to much time

1.8.2. value

1.8.2.1. info

1.8.3. fun

1.8.3.1. amusement

1.9. As a cultural phenomenon FASHION has infinite possibilities

1.10. innovation

1.10.1. mix

1.10.1.1. blogs

1.10.1.2. showrooms

1.10.1.3. press

1.10.1.4. books

1.10.1.5. reading books

1.10.1.6. catwalks

1.10.1.7. painting

1.10.1.8. products

1.10.1.9. video

1.10.1.10. fashion flms

1.10.1.11. shops

1.10.1.12. lifestyles

1.11. show music products

2. 2. loyalty & relevancy

2.1. Shubhankar Ray

2.1.1. Global Brand Director

2.1.2. G-Star RAW

2.1.3. Netherlands

2.2. insights

2.2.1. size isnt everything

2.2.1.1. big are not gonna win

2.2.2. attention economy

2.2.2.1. all fashion cool & fast

2.2.3. context is king

2.2.3.1. one channel

2.3. think & feel: product RAW

2.3.1. property in DNA

2.3.2. inherinting denim

2.3.3. focussed

2.3.4. inspiration

2.3.4.1. industrial instead of fashion

2.3.5. hypenation

2.3.5.1. differentiation

2.3.5.2. never ending production line

2.3.5.2.1. unexepected

2.3.5.2.2. make new out of old

2.3.5.3. well differenriated

2.3.6. gstart = raw

2.3.6.1. uncut

2.3.6.2. unprocessed

2.3.6.3. pure

2.3.6.4. denim

2.3.6.4.1. unwashed

2.3.6.4.2. riged

2.3.6.4.3. beautiful

2.3.7. fobidden combi's

2.3.7.1. authentics

2.3.7.2. unexptected

2.3.7.3. modern

2.3.7.3.1. only 20 years old

2.3.7.3.2. metro denim industry

2.3.8. 3d denim design

2.3.8.1. cross over product

2.3.8.2. elwood launched 1996

2.3.8.2.1. 12 mln pairs

2.3.8.3. 2009 Arc

2.3.8.3.1. like a car designer

2.3.9. denim = core

2.4. mass customization

2.4.1. everyone want to be treathed as single person

2.4.2. raw tailored

2.4.2.1. in store

2.4.2.2. change buttons

2.4.2.3. put name on

2.4.3. high fashion > denim

2.4.4. elevating denim to high fashion

2.4.5. passion for product

2.5. high fashion

2.5.1. tokyo design week

2.5.1.1. where next to car makers, nike

2.5.1.2. high concept

2.5.2. shanghai world expo

2.5.2.1. magnet by liv tyler in mids of shoppign centre

2.5.3. new york fashion

2.5.4. bread & butter berlin

2.5.5. relevance in art world

2.5.6. send a 72 yr old actor on the catwalk for a younth brand

2.5.6.1. dennis hopper

2.6. campaigns

2.6.1. photgraphed anton corbijn

2.6.2. people

2.6.2.1. liv tyler

2.6.2.2. magnus carlson

2.6.2.3. vincent gallo

2.6.2.4. unexpected choices

2.6.2.5. clear idenitity

2.6.3. product campaign

2.6.4. people as media

2.6.4.1. payed to wear vs what they wear in private time

2.6.4.2. people push products

2.6.4.3. you cant buy the celebs buy and wear it

2.6.4.3.1. it will be advertised

2.7. new digital platform

2.8. gstar

2.8.1. $2.2 bln turnover

2.8.2. flagship stores

2.8.3. multiplatform

2.8.3.1. flagship store

2.8.3.2. qstore

2.8.3.2.1. franchise

2.8.3.2.2. local expertise

2.8.3.2.3. nog 100% gstart

2.8.3.3. shop-in-shop

2.8.3.4. ecommerce

2.8.3.5. endcommerce

2.8.3.6. synergy between bricks & clicks

2.9. glocal

2.9.1. macro > micro

2.9.2. multiplatform

2.9.3. interconnected

2.9.4. energie & momentum

3. Q&A

3.1. inbetween model

3.1.1. has other stores

3.1.2. franchisee partner

3.1.2.1. 60% gstar

3.1.2.2. 3 or 4 other brand

3.1.3. independant name

3.2. different market for men and women

3.2.1. masculine brand

3.2.1.1. men stuff

3.2.2. women bough: smaller sizes for them

3.2.3. then women line

3.2.4. opening women only shop

3.3. show differs from others

3.3.1. it was infotainment

3.3.2. info mixed with entertainment

3.3.3. electric charge

3.3.4. invited the bloggers

3.3.5. have lots of followers

3.3.6. different mentality then other brands do

4. closing

5. 1. New Age Branding Strategy (Benetton India – case study)

5.1. Sanjeev Mohanty

5.1.1. Managing Director

5.1.2. Benetton India Pvt Ltd.

5.1.3. India

5.2. india

5.2.1. india interesting market

5.2.1.1. 1.2 bln people

5.2.1.2. 35 countries in one

5.2.1.3. 600+ tv channels

5.2.1.4. 70000 newspapers

5.2.1.5. worlds largest

5.2.1.5.1. democracy

5.2.1.5.2. pool of scientist

5.2.2. consumer paradox

5.2.2.1. tier 1 city

5.2.2.2. lot of contast

5.2.2.3. many headed

5.2.2.4. bicycle class vs business class

5.2.3. consumer profile

5.2.3.1. Teen Riches, Dudes & Dudettes

5.2.3.2. Rural Affluent Folks

5.2.3.3. Call Centre Boomers

5.2.3.4. New age Entrepreneurs

5.2.3.5. Young Professionals

5.2.3.6. Double income No kids

5.2.3.7. The young and the restless

5.2.3.8. Golden Folks in high spirits

5.2.4. 2 mindsets

5.2.4.1. traditional TIM

5.2.4.1.1. value seeker

5.2.4.2. emerging EIM

5.2.4.2.1. succes seeking

5.2.4.2.2. great hope

5.2.5. beliefs

5.2.5.1. limiting

5.2.5.1.1. diff regions diff taste

5.2.5.1.2. big paradox

5.2.5.2. liberating

5.2.5.2.1. mass reach of

5.2.5.2.2. tier 2/3 towns boomtowns

5.2.5.2.3. franchisee model

5.2.5.2.4. tech savy people

5.2.6. usages

5.2.6.1. internet via mobile

5.2.6.2. tablet

5.2.6.3. smartphone

5.2.6.3.1. iphone not so big

5.2.6.4. socialmedia

5.2.6.4.1. facebook: 50 mln users

5.2.6.4.2. twitter: 13 mln

5.2.6.4.3. linkedin: 14 mln

5.2.6.4.4. google+

5.3. benetton

5.3.1. one of 1st brands

5.3.2. top 3 prefferend brands

5.3.3. 400+ stores

6. 4. history and future of fashion shopping

6.1. Koen Snoeren

6.1.1. New Business Development Manager

6.1.2. GfK Panel Services Benelux

6.1.3. Netherlands

6.2. intro

6.2.1. consumer panels

6.3. A fast changing world Fashion facts The future in fashion

6.3.1. world is changing fast

6.3.2. consumer wants certainty

6.3.3. consumer confidence is below 0

6.4. fashion facts

6.4.1. value of fashion is lower then in 2002

6.4.2. hardly a growth

6.4.3. consumer market in fashion declines

6.4.4. fashion is about clothing

6.4.4.1. not

6.4.4.1.1. designers

6.4.4.1.2. glossy magazines

6.4.4.1.3. celberities

6.4.4.1.4. gen x

6.4.4.2. they need to be dressed

6.4.5. who spends money on fashion

6.4.5.1. 40% of all fashion is boigh by people > 50

6.4.6. old group is aging

6.4.6.1. more important

6.4.6.2. a new generation

6.4.6.2.1. buy more cloths

6.5. trend

6.5.1. spending

6.5.1.1. families spens less on cloths

6.5.1.2. youngster spend less on cloths more on other stuff like phones

6.5.2. independants are dissapearing

6.5.3. concentration in fashion retailer

6.5.3.1. not so interantional

6.5.3.2. there is no 1 big retailer whose present in all EU countries

6.5.3.3. promotion

6.5.3.3.1. most is sold in promo 40/ 50%

6.5.4. online

6.5.4.1. Germany >40% is online sold

6.5.4.2. italy/ spain is behind

6.5.4.2.1. due to internet access

6.6. future

6.6.1. 1 junctions

6.6.1.1. shoppign centre > multi fucntional

6.6.1.2. experience

6.6.1.3. cinema

6.6.1.4. leisure

6.6.2. 2 shopping where you are

6.6.2.1. where is the client

6.6.2.2. online

6.6.3. 3 new ret@il

6.6.3.1. both

6.6.3.1.1. online

6.6.3.1.2. offline

6.6.4. 4 co shopping

6.6.4.1. socialmedia

6.6.4.2. consult

6.6.4.2.1. fans

6.6.4.2.2. followers

6.6.4.2.3. friends

6.6.4.3. review mktng

6.6.5. 5 healthy grey

6.6.5.1. elderly people

6.6.5.2. clear demands

6.7. wrap

6.7.1. create loyal customers and become relevant

6.7.2. Client relevance in retail is the ability to have always the right product at the right place available for the right person on the right moment. This during the whole customer journey

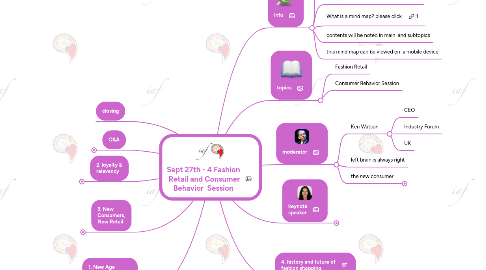

7. info

7.1. welcome to the live mind mapping stream

7.2. Mind Mapped by Alexis van Dam from Connection of Minds

7.3. This mind map will be live updated during the keynotes and forum

7.4. What is a mind map? please click

7.5. contents will be noted in main and subtopics

7.6. this mind map can be viewed on a mobile device

8. topics

8.1. Fashion Retail

8.2. Consumer Behavior Session

9. moderator

9.1. Ken Watson

9.1.1. CEO

9.1.2. Industry Forum

9.1.3. UK

9.2. left brain is always right

9.3. the new consumer

9.3.1. americans in london

9.3.2. speed

9.3.2.1. 1 year 100 mln users of google+

9.3.2.2. ipads

9.3.2.3. apps

9.3.2.4. 3 year old childs: can use an ipad

9.3.2.4.1. cannot read or write

9.3.2.5. from pc to socialmedia

9.3.2.5.1. how many CEO's are provicient in socialmedia

9.3.2.6. apps

9.3.2.6.1. 10 bln apps jan11

9.3.2.6.2. 15 bln apps in 6 months in jun11

9.3.2.6.3. 75 apps for evry iOS user in 6 months

9.3.2.6.4. Fran & Jane

9.3.2.7. nelly.com

9.3.2.7.1. generate traffic

9.3.2.7.2. innovative marketing

9.3.2.7.3. facebook page

9.3.2.8. im not a plastic bag

9.3.3. blogs & tweets

9.3.3.1. London Fashion Week (LFW)

9.3.3.2. new african consumer

9.3.3.2.1. fast growing market

9.3.3.2.2. South Africa

9.3.3.2.3. New node

9.3.4. china

9.3.4.1. convidence fallen signifantly

9.3.4.2. consumes less

9.3.4.3. is big

9.3.4.4. luxury consumption

9.3.4.4.1. $6.5 bln

9.3.4.4.2. growth rate is huge

9.3.4.5. burberry growth slowed down in china

9.3.4.6. BCG decline of wester isnt inevitable

9.3.4.6.1. new ways

9.3.4.6.2. competition

9.3.4.7. chinese in england

9.3.4.7.1. study there

9.3.4.7.2. go to china

9.3.4.7.3. buy english brands in china

10. keynote speaker

10.1. Magdalena Kondej

10.1.1. Global Head of Apparel Research

10.1.2. Euromonitor International

10.1.3. UK

10.2. GLOBAL APPAREL MARKET – THE BIG PICTURE AND THE REGIONAL DIVIDE

10.2.1. around the world

10.2.1.1. consumer is king

10.2.1.1.1. understanding consumers

10.2.1.1.2. regional performance

10.2.1.1.3. per capita spend

10.2.1.2. China

10.2.1.2.1. in 2016

10.2.1.2.2. its not an easy markt

10.2.1.2.3. brands

10.2.1.2.4. ecommerce

10.2.1.3. asia pacific

10.2.1.3.1. hk

10.2.1.3.2. india

10.2.1.3.3. indonesia

10.2.1.3.4. maleisia

10.2.1.3.5. thailand

10.3. SHIFTS IN DEMOGRAPHICS – THE END OF VOLUME GROWTH IN EUROPE

10.3.1. Europe demographics

10.3.1.1. 3 trends

10.3.1.1.1. 1 women are giviing birth later

10.3.1.1.2. 2 Eu consumers are aging

10.3.1.1.3. 3 pop growth slows

10.3.1.2. Eu big 4

10.3.1.2.1. Germ

10.3.1.2.2. Uk

10.3.1.2.3. France

10.3.1.2.4. Italy

10.3.1.2.5. 2012

10.3.1.2.6. 2016

10.3.1.3. EVOLVING CONSUMER PERCEPTION OF QUALITY, VALUE AND LUXURY

10.3.1.3.1. New consumer more demanding

10.3.1.3.2. quality

10.3.1.4. future

10.3.1.4.1. shop for cloths

10.3.1.4.2. power of instore environment

10.3.1.4.3. internet retailing

10.3.1.4.4. mobile

10.4. wrap

10.4.1. geographical expansion

10.4.2. cater tolocal preference

10.4.3. adressing need od older consumers

10.4.4. embrace tech & social aspects