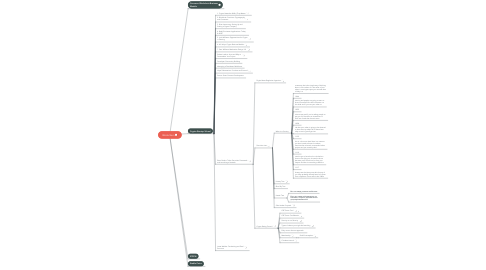

1. Coursera: Blockchain Business Models

1.1. Week 1

1.2. Week 2

1.2.1. Symmetric Ciphers

1.2.2. Symmetric Digital Signatures

1.2.3. Assymetric Digital Signatures

1.2.4. Bitcoin

1.2.5. Cryptocurrencies

1.2.6. Ethereum

1.2.6.1. Ethereum Overview

1.2.6.1.1. History of Ethereum

1.2.6.1.2. Important Concepts

1.2.6.1.3. Ether Denominations

1.2.6.1.4. Ethereum is more general version of Blockchain database

1.2.6.1.5. Accounts

1.2.6.1.6. Wallets

1.2.6.1.7. Smart Contracts

1.2.6.1.8. Token

1.2.6.1.9. dApp

1.2.6.1.10. Big Idea

1.2.6.2. Ethereum Under the Hood

1.2.6.2.1. Ecosystem

1.2.6.2.2. Ethereum vs Blockchain

1.2.6.2.3. Gas

1.2.6.2.4. PoW vs PoS

1.2.6.3. The DAO

1.2.6.3.1. Perhaps the most famous smart-contract ever

1.2.6.3.2. Once a smart contract is deployed it cannot be fixed, unless you compromise the immutability of the smartchain

1.2.7. Private Blockchains

1.3. Week 3

1.4. Week 4

2. Stable Coins

2.1. What is a Stable Coin

2.2. Types

2.2.1. 1. Centralized Regulated Fiat-Backed

2.2.1.1. USDT — USD Tether

2.2.1.1.1. Risks

2.2.1.1.2. Owner

2.2.1.1.3. Launch Date

2.2.1.1.4. Peg Mechanism

2.2.1.1.5. Collateral

2.2.1.1.6. Depeg History

2.2.1.1.7. Controversy

2.2.1.1.8. Manipulating Bitcoin Price

2.2.1.1.9. Resources

2.2.1.2. GUSD — Gemini USD

2.2.1.2.1. https://www.gemini.com/dollar

2.2.1.3. USDC — USD Coin

2.2.1.3.1. Owner

2.2.1.3.2. Collateral

2.2.1.4. BUSD — Binance USD

2.2.1.4.1. Paxos

2.2.2. 2. Decentralized Over-Collateralized

2.2.2.1. Explanation

2.2.2.1.1. These two types are merging

2.2.2.2. Over-collaterized

2.2.2.2.1. Explanation

2.2.2.2.2. DAI

2.2.2.2.3. RAI

2.2.2.2.4. FEI

2.2.2.3. Algorithmic / Under-collatelized

2.2.2.3.1. Explanation

2.2.2.3.2. Algorithmic Stables

2.2.2.3.3. Fully algorithmic Stable Coins

2.2.3. Unsorted Stable Coins

2.2.3.1. USDP — Pax

2.2.3.2. TUSD — True

2.2.3.3. LUSD

2.2.3.4. FPI

2.2.3.4.1. Stable coin pegged to inflation

2.3. Factors of Analysis

2.3.1. Time

2.3.2. Volatility

2.3.3. Size

2.3.4. Risks of Stablecoins

2.3.4.1. To be honest, I don’t know. But a lot of other stablecoins have failed! For instance, of all the stablecoins created in 2015, 80 percent failed, according to Mizrach’s research. And 25 percent of those created in 2018 also failed. That makes the failure rate of stablecoins comparable to other digital assets.

2.3.5. Risks of Stable Coins

2.3.5.1. Safety and liquidity of the reserve assets

2.3.5.2. regulatory risk,

2.3.5.3. counterparty risk (including reserve custodians),

2.3.5.4. transparency over reserves

2.3.5.5. and the extent to which the underlying assets are truly uncorrelated,

2.3.5.6. the legal rights of stablecoin holders,

2.3.5.7. and governance and operational risks.

2.4. Digital Dollar

2.4.1. But one way to make Tether unnecessary is to create a digital dollar, and some US lawmakers seem to be warming to the idea, including Senator Elizabeth Warren (D-MA). (China’s doing something like this already.) A digital dollar would drive out all of the dollar-pegged stablecoins, because that would mean zero counterparty risk, Mizrach says. “That’s the biggest risk to Tether,” he says.

2.5. Portfolio

2.5.1. DAI 50%

2.5.2. USDC 25%

2.6. Resources

2.6.1. https://messari.io/

2.6.2. Stablecoins in Unstable Times

2.6.3. Fitch

2.6.3.1. https://www.fitchratings.com/research/fund-asset-managers/risks-of-stablecoins-highlighted-as-terras-peg-breaks-12-05-2022

2.6.3.2. https://www.fitchratings.com/research/fund-asset-managers/stablecoins-could-pose-new-short-term-credit-market-risks-01-07-2021

2.6.4. S&P

2.6.4.1. https://www.spglobal.com/ratings/en/research/articles/220513-the-current-crypto-downturn-is-a-timely-wake-up-call-12378469

3. STEPN

3.1. Resources

3.1.1. STEPN - Beginners Guide for March 2022

3.2. Choosing Snickers

3.2.1. efficiency > 7

3.2.1.1. Насколько много будет даваться криптовалюты в единицу времении

3.2.1.2. Самый важный

3.2.2. Luck

3.2.2.1. Шанс выпадения лутбоксов

3.2.3. Comfort

3.2.3.1. Нет значения на текущий момент

3.2.4. Resilience > 7

3.2.4.1. Как сильно будут изнашиваться кроссовки

3.2.4.2. Самый важный

3.2.5. Efficiency+Resilience > 12/15

3.2.6. Mint = 0

3.3. https://stepn.guide/

4. Crypto Startup School

4.1. 1. Crypto Networks & Why They Matter

4.1.1. 1. Waves

4.1.1.1. 1. Fly Wheel

4.1.1.1.1. 1. Price is like a hook

4.1.1.2. 2. 2010-2012

4.1.1.3. 3. 2012-2016

4.1.1.4. 4. 2016-2019

4.1.1.5. 5. 3 Waves Agglomeration

4.1.1.6. 6. Growth Rates

4.1.1.7. 7. History of Computing Projects

4.1.2. 2. What is Blockchain

4.1.2.1. 1. Computers that can make commitments

4.1.2.2. 2. Architecture of Blockchain Computers

4.1.2.3. 3. Nodes

4.1.2.4. 4. Consensus Mechanism

4.1.2.5. 5. Blockchain are like early computers

4.2. 2. Blockchain Primitives: Cryptography and Consensus

4.2.1. Layers

4.2.1.1. Layer 1

4.2.1.1.1. How to achieve Consensus?

4.2.1.2. Layer 1.5

4.2.1.2.1. How to run program on Blockchain

4.2.1.3. Layer 4

4.2.2. Execution Environment

4.2.3. General Execution Environments

4.2.4. DeFi Projects

4.2.5. Blockchain Crypto Primitives

4.2.5.1. Signature

4.2.5.2. Aggregated Signature

4.2.5.2.1. Chia

4.2.5.2.2. Allows to reduce the amount of data stored on the blockchain

4.2.5.3. Merkle Commitments

4.2.5.3.1. Commitment

4.2.5.3.2. Merkle Trees

4.2.6. Zero Knowledge Proof Systems

4.2.7. Rollup

4.2.8. When you use Blockchain

4.3. 3. Brian Armstrong: Setting Up and Scaling a Crypto Company

4.3.1. 1. Basics of Crypto Startup

4.3.1.1. 1. Agenda

4.3.1.2. 2. Dot Com Bubble

4.3.1.3. 3. VC Investments in Blockchain

4.3.1.4. 4. Advantages of Crypto

4.3.1.4.1. 1. Fundraising

4.3.1.4.2. 2. Acquiring first customers

4.3.1.4.3. 3. International Expansion

4.3.1.5. 5. Drawbacks of Crypto

4.3.1.5.1. 1. Legal

4.3.1.5.2. 2. Nascent Developer Tools

4.3.1.6. 6. Security or Utility Token

4.3.1.6.1. 1. Security

4.3.1.6.2. 2. cryptoratingconcil.com

4.3.1.7. 7. Different Options to Raise Money

4.3.2. 2. Building a Startup

4.3.2.1. 1. Incorporate

4.3.2.1.1. 1. Delaware C-Corp is probably optimal

4.3.2.1.2. 2. Stripe

4.3.2.1.3. 3. Atlas

4.3.2.2. 2. Fundraising

4.3.2.3. 3. Build Product

4.3.2.4. 4. Issue Token

4.3.2.4.1. 1. Aragon

4.3.2.5. 5. Intergrate Token to an App

4.3.2.6. 6. Launch

4.3.2.7. 7. List on Exchange

4.3.3. 3. CaseStudy: ResearchHub

4.4. 4. Balaji Srinivasan: Applications: Today & 2025

4.4.1. 1. Balaji Srinivasan

4.4.2. 2. History

4.4.2.1. 1. First, Bitcoin

4.4.2.2. 2. Then, Blockchain

4.4.2.3. 3. Next, Ethereum

4.4.2.4. 4. 2017-2018 Boom and Bust

4.4.3. 3. Concepts

4.4.3.1. 1. Blockchani is a database for storing things of value

4.4.3.2. 2. Bitcoin is a protocol

4.4.3.3. 3. Machines can send money

4.4.3.4. 4. Blockchain already 10x'd

4.4.3.5. 5. Blockchains already created billionairs

4.4.3.6. 6. Blockchain gives you choice of who to trust

4.4.3.7. 7. Enables internet-scale cap tables

4.4.3.8. 8. The new mobile-first

4.4.3.9. 9. Blockchains break network effects

4.4.3.10. 10. Transform social networks

4.4.3.11. 11. Privacy putting locally from the cloud

4.4.3.12. 12. Blockchain's value derives from its community

4.4.3.13. 13. Self-Governance

4.4.3.14. 14. Blockchains make macroeconomics experimental science

4.4.4. 4. Applications 2020

4.4.4.1. 1. Exchanges, Mining, Issuance

4.4.4.2. 2. Harware Wallets

4.4.4.3. 3. Stablecoins

4.4.4.4. 4. DeFi

4.4.5. 5. Applications 2025

4.4.5.1. 1. Privacy Coins

4.4.5.2. 2. Lending & Interest

4.4.5.3. 3. Scaling

4.4.5.4. 4. Decentralized Cold Storage

4.4.5.5. 5. SaaS-for-gas

4.4.5.6. 6. Insurance

4.4.5.7. 7. Multiwallets

4.4.5.8. 8. Security Innovation

4.4.5.9. 9. Novel Financial Instruments

4.4.5.10. 10. Blockchain Games

4.4.5.11. 11. Crypto Social Networks

4.4.5.12. 12. Decentralized DNS

4.4.5.13. 13. Automated Market Making

4.4.5.14. 14. Decentralized Identity

4.4.5.15. 15. Personal Tokenization

4.4.5.16. 16. Mutuals & Guilds

4.4.5.17. 17. Founder's Reward

4.4.5.18. 18. On-Chain Bounties

4.4.5.19. 19. Clients for DApps

4.4.5.20. 20. Developer Tools

4.4.5.21. 21. Oracles and Prediction Markets

4.4.5.22. 22. DAO

4.4.5.23. 23. Community-Owned Organizations

4.5. 5. Josh Williams: Opportunities for Crypto in Gaming

4.5.1. 1. Four Ways to improve games

4.5.1.1. 1. Players can really own their goods inside the games

4.5.1.1.1. 1. You can sell your 70lvl Rouge to play a Warrior

4.5.1.2. 2. Provinance of items

4.5.1.3. 3. Rich marketplaces inside the games

4.5.1.3.1. 1. You have 100% trust that the thing is real

4.5.1.3.2. 2. This is THE sword

4.5.1.4. 4. Rich incentive systems that can reward the players in different ways

4.5.1.4.1. 1. Incentive mechanisms to motivate players to do the right thing

4.5.2. 2. Problems of Free to Play

4.5.2.1. 1. 1% of players give 80% of revenue, at it is frustrating for those who don't spend that much

4.5.2.2. 2. Extremely difficult design market

4.5.3. 3. Four Ways to make Revenue

4.5.3.1. 1. Sell goods as usual

4.5.3.2. 2. Fiscal policy - set the fees, and taxes

4.5.3.3. 3. Developers can own their own assets

4.5.3.4. 4. Monetary Policy - set rates of inflation

4.5.3.4.1. 1. Reward for different types of behavior

4.5.4. 4. Why put it on the blockchain

4.5.4.1. 1. Really hard to secure that in the centralized database

4.5.4.2. 2. Size of the economy you can create - solves the issue of trust of new-comers and existing players

4.5.4.3. 3. Even if the developer wants to overwrite the characteristics ascribed to an asset, the players can punish the developer to

4.6. 6. Ali Yahya: Crypto Business Models

4.6.1. Blockchain are computers

4.6.1.1. they are computers in the sense that a network of participants

4.6.1.2. comes together in via a consensus algorithm form something that looks very

4.6.1.3. much like a computer to a developer

4.6.2. Blockchain are ecosystems

4.6.2.1. Layer 0, 1, 1.5 - combined make a complete blockchain computer

4.6.2.1.1. from the very bottom in order for anything to happen we first need computational hardware so that is the

4.6.2.1.2. hardware layer which we call layer zero which includes like miners and

4.6.2.1.3. validators which I'm sure it's something you're familiar with with the previous previous lectures that we've already gone through and it includes some of the

4.6.2.1.4. peer-to-peer network networking protocols that allow the participants at that layer to be able to communicate with one another

4.6.2.1.5. and and eventually come to an agreed-upon state for what the network

4.6.2.1.6. for weather network looks like and that's where the consensus layer comes in all these people all of the

4.6.2.1.7. participants at the hardware layer communicate via peer-to-peer networking algorithms and need to come to agreement

4.6.2.1.8. about what the truth is about the network that is what is the state of this blockchain computer that they're

4.6.2.1.9. working towards maintaining and that for example could be like how much cryptocurrency any one participant in

4.6.2.1.10. the network has or it could be like how many crypto kiddies this person has bridge to that that person or like

4.6.2.1.11. whatever other kind of crypto collectible or crypto good the blockchain computer is tracking and so

4.6.2.1.12. once all of these participants are able to come to agreement about what the state is they have to be able to compute

4.6.2.1.13. on top of that state in a way that is verifiable in a way that is guaranteed by the game theoretical mechanics of the

4.6.2.1.14. of the network to be correct and that's where the compute layer comes in and it's worth noting both of these two

4.6.2.1.15. layers the consensus layer and the compute layer tend to be bundled together almost almost always in almost

4.6.2.1.16. every system so both of those together tend to be known as layer one and these three layers together layer 0 layer 1

4.6.2.1.17. and layer 1.5 combine to make a complete blockchain computer so on top of it

4.6.2.1.18. developers can actually deploy programs that they write and have the computer run run those programs there are various

4.6.2.1.19. different challenges at each level and as you would expect there are multiple startups that have been started to

4.6.2.1.20. address the various challenges at each subsequent level so for example at the

4.6.2.1.21. hardware layer the the key challenges tend to be challenges of provisioning computational resources of ensuring that

4.6.2.1.22. there is bandwidth and connectivity between the various different nodes in the network and of managing and

4.6.2.1.23. operating large-scale data centers the key challenges at the lover level above the consensus layer have to do with

4.6.2.1.24. making sure that there really is only one true version of the state of the computer at any point in time and that

4.6.2.1.25. no one is subverting the truth that that everyone can agree upon the key challenges at layer 1.5

4.6.2.1.26. to do with making sure that the computations are executed correctly and that no one sneaks in some some computation that that happens to steal

4.6.2.1.27. like some cryptocurrency from one user or another so those three layers give you a blockchain computer

4.6.2.2. Layer 2

4.6.2.2.1. then on top of

4.6.2.2.2. 4:39

4.6.2.2.3. that we have layer two which consists it essentially you can think of layer two

4.6.2.2.4. 4:46

4.6.2.2.5. as a kind of substrate for as a computational substrate for the programs that developers write that run on the

4.6.2.2.6. 4:52

4.6.2.2.7. blockchain computer and those programs are known as smart contracts and smart contracts or the fundamental building

4.6.2.2.8. 4:58

4.6.2.2.9. block for everything that ever gets built on top of a blockchain

4.6.2.3. Layer 3

4.6.2.3.1. and then finally we've got layer three the user

4.6.2.3.2. interface which is really just made up of like the code that runs on your mobile phone or the code that runs on

4.6.2.3.3. your web browser and it can include things like for example your wallet an

4.6.2.3.4. exchange or like the the application that you use to interact with like this

4.6.2.3.5. the smart contract that manages your crypto kiddies or whatever whatever else you may be doing with with a blockchain

4.6.2.3.6. it ends up being the bridge that connects the world of protocols with the world with the world of people now I

4.6.3. Layer 1

4.6.3.1. Flywheel

4.6.4. Value Capture Paradox

4.6.4.1. Network Effect

4.6.4.1.1. phenomenon that the value of a network to a new user tends to increase with

4.6.4.1.2. respect to the number of users who are already in the network and so they

4.6.4.1.3. he canonical examples this was first 14:37 noticed at the dawn of the telecommunications industry with just telephone but like a telephone network 14:44 where you have a network that has only one user then it's not very useful because if there's no one you can really call if there are two two people in that 14:52 network then a new user joining can now call two people so it's a little bit more useful and the more people that are 14:57 in the network the more valuable the network becomes to the next marginal user the same applies with social 15:03 networks you want to be on the social network that has the most users as opposed to ones that that have have 15:08 fewer and even currency has a kind of network effect because the more people 15:15 accept any one form of currency and the more value that currency offers a new 15:21 person who might want to transact in it and might want to to hold it or or use it for as a medium of exchange

4.6.4.2. Cross-Side Network Effect

4.6.5. Network Flywheel

4.6.6. Examples

4.6.6.1. Maker

4.6.6.2. Uniswap

4.6.6.3. Compound

4.6.7. Layer 2 Business Model

4.6.7.1. Network Effects

4.7. 7. Sam Williams: Mechanism Design 101

4.7.1. 1. Definition

4.7.1.1. 1. Mechanism Design

4.7.1.1.1. 1. programming human behavior through the careful design of incentives in this talk I would like to posit the theory

4.7.1.1.2. 2. that essentially humans are just like machines that we would normally program but instead of responding to and running

4.7.1.1.3. 3. programs in a traditional sense so applications that are series of instructions that the computer must

4.7.1.1.4. 4. execute in order to be in line with you know a properly functioning CPU instead

4.7.1.1.5. 5. what we have is people that led by goals towards wealth through incentive systems

4.7.1.2. 2. Steak Example

4.7.1.2.1. 1. so this is really quite simple in a nutshell we see that humans are machines

4.7.1.2.2. 2. they want to achieve goals and they plan their way towards those goals through

4.7.1.2.3. 3. sub goals so one of these goals might be I would like to go home after this and have a stake and as a consequence as

4.7.1.2.4. 4. soon as I desire that my mind starts to think okay well what are the sub goals

4.7.1.2.5. 5. involved in reaching that position in life so we see that on the way to these

4.7.1.2.6. 6. meta goals we go through sub goals like with the steak for example I need to go

4.7.1.2.7. 7. to a shop I need to buy the steak I also need to have a house in which to cook it right so we see there are these sub

4.7.1.3. 3. Money is a key incentive

4.7.1.3.1. 1. fact money is the unifying sub goal for almost all larger goals in life and

4.7.1.3.2. 2. before money we had essentially this mechanism where there was in order to

4.7.1.3.3. 3. have a transaction there must be a double coincidence of value so that means in practice is that

4.7.1.3.4. 4. if I want to have a stake I need to go and I'm a carpenter say I need to go and

4.7.1.3.5. 5. I need to find someone that wants to buy a table from me that I've made and swap it for some amount of stake this is

4.7.1.3.6. 6. obviously a very very inefficient system so one of the first mechanism designs the humans made was like okay well what

4.7.1.3.7. 7. is a global generic sub goal and that we would say is money that is everybody

4.7.1.3.8. 8. wants money and as a consequence we can freely exchange through money for other

4.7.1.4. 4. Design economic design effectively

4.7.1.5. 5. You can take this same mechanism, you can apply ... to give a fair market value for this

4.7.1.5.1. 1. Distribute $2000 among people

4.7.1.5.2. 2. The market will decide the price with supply and demand

4.7.2. 2. Examples

4.7.2.1. 1. Collecting beer bottles in Europe for 30 cents a piece

4.7.2.2. 2. Charging scooters

4.7.2.2.1. 1. Centralling planning system

4.7.2.2.2. 2. For every scooter that you charge, we will give you some reward

4.7.2.3. 3. Torrent

4.7.2.3.1. 1. doesn't have to be money

4.7.2.3.2. 2. I will give you data if you give me data

4.7.2.4. 4. Bitcoin

4.7.3. 3. Designing Economic Game in Three Steps

4.7.3.1. 1. Steps

4.7.3.1.1. 1. Choose a goal

4.7.3.1.2. 2. Choose a reward mechanism

4.7.3.1.3. 3. Choose a reward function to match it

4.7.3.2. 2. Examples

4.7.3.2.1. 1. Bitcoin

4.7.4. 4. 3.

4.8. Robert Leshner: How and Why to Decentralize Your Project

4.8.1. Why decentralization is important

4.8.1.1. Helps to build trust

4.8.1.2. As platforms grow instead of cooperating they start extracting

4.8.1.2.1. Twitter example: removed API

4.8.1.2.2. Spotify the same thing

4.8.1.3. Reward users for favourable behavior with tokens

4.8.2. Difference in building a crypto startup

4.8.2.1. GTM - go to market strategy

4.8.3. Three objectives of Crypto App

4.8.3.1. 1. Building a product people want

4.8.3.1.1. No pretence of decentralization

4.8.3.2. 2. Build a Community

4.8.3.2.1. 3. Designing effective token distribution plan

4.8.3.2.2. Make right incentive to invite favourable community participation

4.8.3.3. 3. Exiting to the community

4.8.4. Case Study: Compound

4.8.4.1. What is compound

4.8.4.1.1. so compound is a market for 17:25 interest rates on crypto assets it lives as a smart contract on aetherium and for 17:32 a number of supported aetherium assets our protocol is created interest rates an application or a user or any 17:40 aetherium address can earn if they have the asset and supplied to the protocol or that an application or user can pay 17:47 to borrow an asset from the

4.8.5. Developer community building

4.8.5.1. You could launch applications built on top of compound

4.8.5.2. 100% of effort devoted to

4.8.5.3. Working on documents, guides, content, things that make the entire process where the user is a developer

4.8.5.4. Discord for developers, it is really active. One of the most active discords in crypto.

4.8.6. Why community ownership is so important to compound

4.8.6.1. Allows the protocol to live forever

4.8.6.1.1. If Bitcoin was run by some centralized body it would not be there by now

4.8.6.2. Enables wider audience to upgrade

4.8.6.2.1. The pace of evlution is going to accelerate once we decentralize

4.8.7. Always communicated that the goal is to decentralize the protocol

4.8.7.1. 1. Restricting our ability to make certain changes to the protocol

4.8.7.2. 2. Writing documentation around transperancy of governance

4.8.8. 3 Phase decentralization

4.8.8.1. Phase 1

4.8.8.1.1. All changes are done by centralized body but it's

4.8.8.2. Phase 2

4.8.8.2.1. sand-box decentralization

4.8.8.3. Phase 3

4.8.8.3.1. Handing it off entirely to the community

4.9. Developer Community Building

4.10. Managing a Distributed Workforce

4.11. Nitya Subramanian: Products and Protocol

4.12. Secure Smart Contract Development

4.13. Brian Brooks: Token Securities Framework and Launching a Network

4.13.1. Digital Asset Regulation Agencies

4.13.2. Securities Law

4.13.2.1. What is a Security

4.13.2.1.1. customers that's the simple way of thinking about it if the token of if the value of your token is contingent upon your success then it likely is a

4.13.2.1.2. 10:46

4.13.2.1.3. security and people are going to want to know information like the information on this slide and if you use your token to

4.13.2.1.4. 10:52

4.13.2.1.5. raise money and if you're asking people to pay you for the token an investment of their own funds then there's some

4.13.2.1.6. 10:58

4.13.2.1.7. risk that your token is going to be deemed to be a security subject all of these laws okay so we're gonna get into

4.13.2.1.8. 11:03

4.13.2.1.9. this in a lot more detail here in a moment you don't need to know a lot about securities law to launch a successful token project and you certainly don't

4.13.2.1.10. 11:10

4.13.2.1.11. need to go to law school to do that but there's one thing you do need to know because you'll hear this a lot from your lawyers and that is something called the

4.13.2.1.12. 11:17

4.13.2.1.13. Howey test the Howey test which many of you have probably already heard of comes from a Supreme Court case in the 1940s

4.13.2.2. Howey Test

4.13.2.3. Blue Sky Test

4.13.2.4. Hawaii Test

4.13.2.4.1. Все эти люди уезжают на багамы

4.13.2.4.2. Если эти люди действительно не влюияют, тогда он дейтсвительно децентрализованный

4.13.2.5. Safe Harbor Proposal

4.13.3. Crypto Rating Council

4.13.3.1. CRC Score Card

4.13.3.2. CRC Score Card Metrics

4.13.3.3. Security or not Security

4.13.3.4. Types of tokens you might be launching

4.13.3.5. Early mover discount approach

4.13.3.5.1. factors in our scorecard that will mean coinbase and others will likely not list you so the trick here is to be very very

4.13.3.5.2. 25:16

4.13.3.5.3. careful about how you market this token right it's to make very clear that the reason you're selling the token is because you're gonna build something

4.13.3.5.4. 25:23

4.13.3.5.5. valuable that people will want access to in the future and you're not selling the token for investment purposes you're

4.13.3.5.6. 25:29

4.13.3.5.7. selling the token because people can get an early mover discount for this thing that's going to happen later so imagine

4.13.3.5.8. 25:36

4.13.3.5.9. if you're getting the early tickets to the next Star Wars movie before they've gone retail the movie might or might not

4.13.3.5.10. 25:42

4.13.3.5.11. be good but the odds are that the tickets are gonna cost 20 bucks and for 10 bucks today you can buy an early

4.13.3.5.12. 25:47

4.13.3.5.13. ticket right as the early ruler just kept that works some of these things also have other features and as long as

4.13.3.5.14. 25:54

4.13.3.5.15. there's no requirement that people opt into those features instead they're simply buying access to the network that

4.13.3.6. Membership

4.13.3.6.1. Real-life examples

4.13.3.7. Coinbase Launch

4.14. Jesse Walden: Fundraising and Deal Structure

4.14.1. Startup Financing

4.14.1.1. Financial Capital

4.14.1.2. Production Capital

4.14.1.2.1. Comes not only from the team, but also from the community

4.14.2. Three Objectives of the Crypto App

4.14.3. Series of Financing Rounds

4.14.3.1. Crypto products are different at later stages —> company moves into community ownership

4.14.3.2. Community has a direct economic incentive to do so

4.14.4. Equity with rights to Tokens

4.14.4.1. we've structured many deals is as an equity purchase in a company but one that comes with rights to tokens so that

4.14.4.2. 6:13

4.14.4.3. as if the team builds a product or network that produces token a token then

4.14.4.4. 6:18

4.14.4.5. the the investors will receive some of those tokens in proportion to their

4.14.4.6. 6:24

4.14.4.7. ownership stake in the company and just like equity aligns investors with

4.14.4.8. 6:29

4.14.4.9. founders in a company this token right aligns investors with founders and teams

4.14.4.10. 6:34

4.14.4.11. if the company builds a decentralized network coordinated by a token

4.14.5. Types of Financing

4.14.5.1. Equity

4.14.5.1.1. Equity may come with rights to tokens

4.14.5.1.2. Will receive tokens in proportion with their stake in equity

4.14.5.1.3. Dilution

4.14.5.1.4. Example

4.14.5.2. Crypto

4.14.6. Network Monetary Policy

4.14.6.1. Example

4.14.6.1.1. Bitcoin

4.14.6.1.2. Ethereum

4.14.6.1.3. Inflationary models with staking

4.14.7. Evolution of Crypto Financing

4.14.8. Key Takeaways