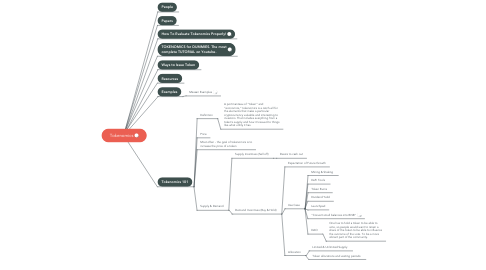

1. Tokenomics 101

1.1. Definition

1.1.1. A portmanteau of “token” and “economics,” tokenomics is a catch-all for the elements that make a particular cryptocurrency valuable and interesting to investors. That includes everything from a token’s supply and how it’s issued to things like what utility it has.

1.2. Price

1.3. Most often - the goal of tokenomics is to increase the price of a token

1.4. Supply & Demand

1.4.1. Supply Incentives (Sell off)

1.4.1.1. Desire to cash out

1.4.2. Demand Incentives (Buy & Hold)

1.4.2.1. Expectation of Future Growth

1.4.2.2. Use Case

1.4.2.2.1. Mining & Staking

1.4.2.2.2. DeFi Tools

1.4.2.2.3. Token Burns

1.4.2.2.4. Dividend Yeild

1.4.2.2.5. Launchpad

1.4.2.2.6. “Convert small balances into BNB”

1.4.2.2.7. DAO

1.4.2.3. Allocation

1.4.2.3.1. Limited & Unlimited Supply

1.4.2.3.2. Token allocations and vesting periods

2. TOKENOMICS for DUMMIES. The most complete TUTORIAL on Youtube.

2.1. Market Capitalization

2.1.1. Definition

2.1.1.1. Total value of project's circulating supply in the project's history

2.1.1.2. At TGE

2.1.1.2.1. Quantity sold at TGE times the price

2.1.1.3. Hard Cap

2.1.1.3.1. Total amount of money that was raised in presell from the project itself

3. How To Evaluate Tokenomics Properly!

3.1. 1. Market Capitalization

3.1.1. MC = TokenPrice * CirculatingSupply

3.2. 2. Fully Diluted Market Capitalization

3.2.1. FDMC = TokenPrice * MaxSupply

3.3. 3. Max Supply

3.3.1. How many more tokens need to be absorbed by the market in the future

3.3.2. Some projects don't have a cap on future inflation, in that case they do not have a max supply

3.4. 4. Monetary Policy

3.4.1. Inflation or deflation of the token supply, ie how fast token are released

3.4.2. And how this rate is going to change in the future

3.5. 5. Token Distribution

3.5.1. Initial Token Distribution

3.5.1.1. How token were distributed at launch

3.5.1.2. Messary initial token allocation for public blockchains

3.6. 6. Private Sales Prices

3.6.1. Important to know the private rounds sales prices, to gauge their willingness to sell at certain prices

3.7. 7. Unlock Schedule

3.7.1. Unlock schedule specifies what percentage is released, to whom, at what interval

3.7.2. Vesting Schedule

3.7.2.1. Amount of tokens released to the early investors schedule

3.8. 8. Token Utility

3.8.1. 1. Payments

3.8.1.1. Bitcoin

3.8.1.2. Lightcoin

3.8.2. 2. Transaction Fees

3.8.2.1. Ethereum

3.8.3. 3. Access to Services

3.8.3.1. Storj

3.8.4. 4. Discounts or cashback

3.8.4.1. BNB

3.8.5. 5. Staking

3.8.6. 6. Governance

4. Ways to Issue Token

4.1. Presell

4.1.1. A way of selling a token (fungible or not) in advance of it being usable. Often this is utilised much like a crowdfunding campaign, where future players buy tokens to fund future development.

4.2. ICO

4.2.1. Initial Coin Offerings are a way of preselling or launching securities tokens for open trading, much like an IPO (Initial Public Offering) on a stock exchange.

4.3. Player Purchase

4.3.1. Direct purchase by the player

4.4. Player Rewards

4.4.1. A reward for play, such as winning tournaments.

4.5. Developer Rewards

4.5.1. A payment for the proposal and delivery of some feature, bug fix or other software development by an external party. Includes bug bounties.

4.6. Advisor

4.6.1. A payment to some external advisor, such as the tokenomics creators, in order to align their motivations with the long term health of the token.

4.7. Faucets

4.7.1. A website whereby players can earn a token either for free or by taking some action, such as completing a survey or signing up to a mailing list.

4.8. Airdrops

4.8.1. The process of sending tokens to addresses for free in order to promote the token or associated game. Often these are sent to the addresses of those who have signed up for an airdrop or an active member of a community.

5. Resources

5.1. Books

5.1.1. https://www.amazon.com/Free-Play-Making-Money-Games/dp/0321919017

5.2. Articles

5.2.1. https://departmentofplay.net/deconstructing-axie-infinity-is-play-to-earn-the-future/

5.2.2. https://departmentofplay.net/tokenomics-how-to-design-economies-for-crypto-games/

6. Papers

6.1. Lisa

6.1.1. Three Design Fundamentals

6.1.1.1. Explanation

6.1.1.1.1. This paper proposes that, to build a robust digital and distributed ecosystem, one has to consider the factors within the 3 main pillars in token economics: market design, mechanism design and token design.

6.1.1.1.2. Together, they build the underlying architecture of the ecosystem, which can be engineered to optimise the specific objectives of the ecosystem.

6.1.1.2. Market Design

6.1.1.2.1. Methodology

6.1.1.2.2. Factors of Market Design

6.1.1.3. Mechanism Design

6.1.1.3.1. Explanation

6.1.1.3.2. Factors of Mechanism Design

6.1.1.4. Token Design

7. People

7.1. Upwork

7.1.1. https://www.upwork.com/services/product/tailored-tokenomics-for-your-play-to-earn-game-1483052560852590592