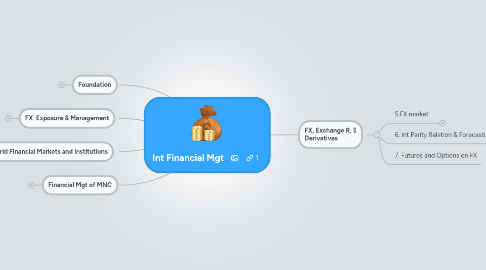

1. Foundation

1.1. 1. Glob & MNC

1.1.1. International” Finance

1.1.1.1. Foreign Exchange Risk Political Risk Market Imperfections Expanded Opportunity Set

1.1.1.2. Goals for International Financial Management

1.1.1.2.1. Maximization of shareholder wealth

1.1.1.3. Globalization of the World Economy: Major Trends and Developments

1.2. 2. Int Monetary System

1.2.1. Rev IMF

1.2.1.1. Bimetallism: Before 1875

1.2.1.2. Classical Gold Standard: 1875-1914

1.2.1.3. Interwar Period: 1915-1944

1.2.1.4. Bretton Woods System: 1945-1972

1.2.1.5. The Flexible Exchange Rate Regime: 1973-Present

1.3. 3. Balance of Payment

1.3.1. B of Payment Accounting

1.3.1.1. Transaction, Exports (+ Credit), Import (- Debit)

1.3.2. B of Payment Accounts BCA+BKA+BRA = 0 (BOPI)

1.3.2.1. Current Acct

1.3.2.1.1. merchandise trade

1.3.2.1.2. services

1.3.2.1.3. factore income

1.3.2.1.4. unilateral transfer

1.3.2.2. Capital Acct

1.3.2.2.1. FDI

1.3.2.2.2. Portfolio investment

1.3.2.2.3. Other invest

1.3.2.3. Offical Reserve Acct

1.3.2.3.1. Gold

1.3.2.3.2. FX es

1.3.2.3.3. SDR Special Drawing rights

1.3.2.3.4. Reserve positions in IMF

1.3.3. B of Payment Trends in Major Countries

1.3.3.1. eg. Mercantilism (trade suplus)

1.4. 4. Corp Gov

1.4.1. Agency Problem

1.4.2. Remedies for the Agency Problem

1.4.2.1. Board of Directors

1.4.2.2. Incentive contracts (Share options)

1.4.2.3. concentracted ownership 51% share

1.4.2.4. Accounting Transparency

1.4.2.5. Debt

1.4.2.6. Overseas stock listings

1.4.2.7. Market for corporate control

1.4.3. Law & Cor Goverance

1.4.4. Consequences of Law

1.4.5. Corp Gov reform

2. FX Exposure & Management

2.1. 8. Mgt of Transaction Exposure

2.2. 9. Mgt of Economic Exposure

2.3. 10. Mgt of Translation Exposure

3. World Financial Markets and Institutions

3.1. 11. Int Banking & Money Market

3.2. 12. Bond Market

3.3. 13. Equity Markets

3.4. 14. Interest Rate and Currency Swaps

3.5. 15. Int Portfolio Investment

4. Financial Mgt of MNC

4.1. 16. FDI & Acquisitions

4.2. 17. Capital Structure and the Cost of Capital

4.3. 18. Capital Budgeting

4.4. 19. Cash Management

4.5. 20. Trade Finance

4.6. 21. Tax Environment and Transfer Pricing

5. FX, Exchange R, $ Derivatives

5.1. 5.FX market

5.1.1. The Spot Market

5.1.1.1. Spot Rate Quotations

5.1.1.1.1. Direct Q= USD/Foreign = USD/AUD = 1. 3 USD/1 AUD

5.1.1.1.2. Indirect Q = Foreign/USD = 0.77 AUD/1USD

5.1.1.2. Cross Exchange Rate

5.1.1.2.1. S (€/£) = S($/£) /S($/€)

5.1.1.3. Alternative Expression for CER

5.1.1.3.1. S(j/k) = S($/k) x (j/$)

5.1.1.4. Bid-Ask Spread

5.1.1.4.1. (Ask Price – Bid Price) / Ask Price

5.1.1.5. Triangular Arbitrage

5.1.1.5.1. Slide 24-26

5.1.1.6. Spot FX Microstructure

5.1.2. Forward Market

5.1.2.1. Forward Rate Quotations Long and Short Forward Positions Forward Cross Exchange Rates Forward Premium Swap Transactions

5.1.3. ETF (Exchange Traded Fund)

5.1.3.1. .

5.1.4. Spot FX Trading

5.2. 6. Int Parity Relation & Forecasting FX Rate

5.2.1. Interest Rate Parity

5.2.1.1. Covered Interest Arbitrage

5.2.1.2. IR parity & Ex R determination

5.2.1.3. Currency Carry Trade

5.2.1.4. Reasion of Deviation from IR P

5.2.2. PPP Purchasing power parity

5.2.2.1. PPP Deviations & Real Ex Rt

5.2.2.2. Evidence on PPP

5.2.3. Fisher Effects

5.2.4. Forecasting Exchange Rate

5.2.4.1. Efficient Market Approach

5.2.4.2. Fundamental Approach

5.2.4.3. Technical Approach

5.2.4.4. Performance of the forecasters