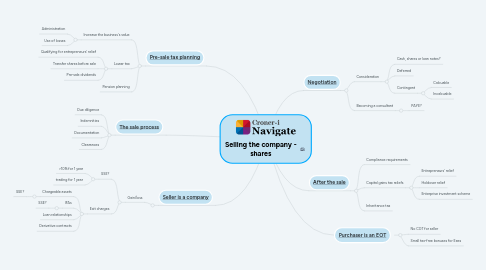

Selling the company - shares

by Meg Wilson

1. [Pre-sale tax planning](https://library.croneri.co.uk/navigate-taxb/po-heading-id_GA504Kn4qEmZlv9BYKV0PQ)

1.1. Increase the business's value

1.1.1. Administration

1.1.2. Use of losses

1.2. Lower tax

1.2.1. Qualifying for entrepreneurs' relief

1.2.2. Transfer shares before sale

1.2.3. Pre-sale dividends

1.3. Pension planning

2. [The sale process](https://library.croneri.co.uk/navigate-taxb/po-heading-id_bwClsscv_E2N_sJBWx2LLA)

2.1. Due diligence

2.2. Indemnities

2.3. Documentation

2.4. Clearances

3. [Seller is a company](https://library.croneri.co.uk/navigate-taxb/po-heading-id_ko0fS0QzCkyTCwORCsSa6w)

3.1. Gain/loss

3.1.1. SSE?

3.1.1.1. >10% for 1 year

3.1.1.2. trading for 1 year

3.1.2. Exit charges

3.1.2.1. Chargeable assets

3.1.2.1.1. SSE?

3.1.2.2. IFAs

3.1.2.2.1. SSE?

3.1.2.3. Loan relationships

3.1.2.4. Derivative contracts

4. [Negotiation](https://library.croneri.co.uk/navigate-taxb/po-heading-id_Q33zeUOcc0W9BuhirJBExg)

4.1. Consideration

4.1.1. Cash, shares or loan notes?

4.1.2. Deferred

4.1.3. Contingent

4.1.3.1. Calcuable

4.1.3.2. Incalcuable

4.2. Becoming a consultant

4.2.1. PAYE?

5. [After the sale](https://library.croneri.co.uk/navigate-taxb/po-heading-id_F_xoegJxx0-ZFM2c2-ugSQ)

5.1. Compliance requirements

5.2. Capital gains tax reliefs

5.2.1. Entrepreneurs' relief

5.2.2. Holdover relief

5.2.3. Enterprise investment scheme