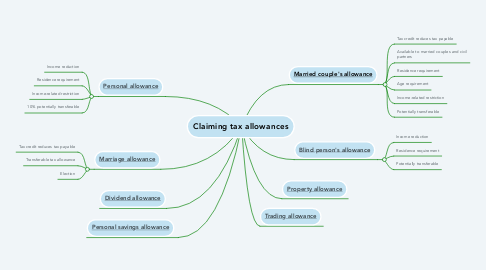

Claiming tax allowances

by David Amofah

1. [Personal allowance](https://library.croneri.co.uk/navigate-taxi/po-heading-id_nXQlcTElaUuN7rruJQ2L4g)

1.1. Income reduction

1.2. Residence requirement

1.3. Income-related restriction

1.4. 10% potentially transferable

2. [Marriage allowance]( https://library.croneri.co.uk/navigate-taxi/po-heading-id_iY-4VHVNTkmJaDG984rOEA )

2.1. Tax credit reduces tax payable

2.2. Transferable tax allowance

2.3. Election

3. [Dividend allowance](https://library.croneri.co.uk/navigate-taxi/po-heading-id_fEV-f8UdLEmStAhb2URkZw)

4. [Personal savings allowance](https://library.croneri.co.uk/navigate-taxi/po-heading-id_Te_rbRzSN0KZQ8J-xi02MA)

5. [Married couple's allowance](https://library.croneri.co.uk/navigate-taxi/po-heading-id_-QPVUK79r0mZR1AAUNXjmA)

5.1. Tax credit reduces tax payable

5.2. Available to married couples and civil partners

5.3. Residence requirement

5.4. Age requirement

5.5. Income-related restriction

5.6. Potentially transferable

6. [Blind person's allowance](https://library.croneri.co.uk/navigate-taxi/po-heading-id_xLEac3jWsU22R9HZZMB6Dg)

6.1. Income reduction

6.2. Residence requirement

6.3. Potentially transferable

7. [Trading allowance](https://library.croneri.co.uk/navigate-taxi/po-heading-id_3GyTAGjxgEyFQDax9uXhjA)

8. [Property allowance](https://library.croneri.co.uk/navigate-taxi/po-heading-id_G3iveCUCL0mNEmNsEcYpug)