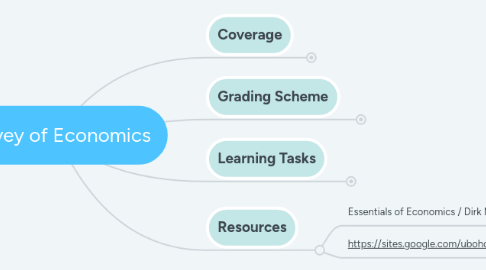

1. Coverage

1.1. A. Introduction

1.1.1. 1. Economic Thinking

1.1.1.1. What is economics

1.1.1.2. What are the 4 ways to think like an economist

1.1.2. 2. Economic Models

1.1.2.1. How do economists study the economy

1.1.2.2. What is a production possibilities frontier

1.1.2.3. What are the benefits of specialization and trade

1.1.2.4. How does the economy work

1.1.3. 3. Supply and Demand

1.1.3.1. What are the fundamentals of a market economy

1.1.3.2. What determines demand

1.1.3.3. What determines supply

1.1.3.4. How do supply and demand shifts affect a market

1.1.4. 4. Market Efficiency

1.1.4.1. What are consumer surplus and producer surplus

1.1.4.2. When is a market efficient

1.1.4.3. When do price ceilings matter

1.1.4.4. What effects do price ceilings have on economic activity

1.1.4.5. When do price floors matter

1.1.4.6. What effects do price floors have on economic activity

1.2. B. Microeconomics

1.2.1. 5. Profits

1.2.1.1. What are the roles of profits

1.2.1.2. How are profits and losses calculated

1.2.1.3. How much should a firm produce

1.2.2. 6. Market Structures

1.2.2.1. How do competitive markets work

1.2.2.2. How are monopolies created

1.2.2.3. How much do monopolies charge, and how much do they produce

1.2.2.4. What are the problems with monopoly

1.2.2.5. What are monopolistic competition and oligopoly

1.2.3. 7. Behavioral Economics

1.2.3.1. How can economists explain irrational behavior

1.2.3.2. What is the role of risk in decision-making

1.2.3.3. How does game theory explain strategic behavior

1.2.4. 8. Labor Markets

1.2.4.1. Where does the demand for labor come from

1.2.4.2. Where does the supply of labor come from

1.2.4.3. how does the labor market achieve equilibrium

1.2.4.4. Why do some workers make more than others

1.2.4.5. What additional factors determine wages

1.2.5. 9. Role of Government

1.2.5.1. What are the roles of government in the economy

1.2.5.2. What are property rights and private property

1.2.5.3. What are private goods and public goods

1.2.5.4. What are the challenges of providing non-excludable goods

1.2.5.5. What are externalities, and how do they affect markets

1.3. C. Macroeconomics

1.3.1. 10. Macroeconomics

1.3.1.1. How is macroeconomics different from microeconomics

1.3.1.2. What are the three major topics in macroeconomics

1.3.1.3. What are the schools of thought in macroeconomics

1.3.2. 11. Macroeconomic Measures

1.3.2.1. How is GDP computed

1.3.2.2. What are some shortcomings of GDP data

1.3.2.3. What can we learn from unemployment data

1.3.2.4. How is inflation measured

1.3.2.5. What problems does inflation bring

1.3.3. 12. AD/AS

1.3.3.1. What is a business cycle, and why are business cycles so difficult to predict

1.3.3.2. What is aggregate demand

1.3.3.3. What is aggregate supply

1.3.3.4. How does the aggregate demand–aggregate supply model help us understand the economy

1.3.4. 13. Wealth of Nations

1.3.4.1. Why does economic growth matter

1.3.4.2. How do resources and technology contribute to economic growth

1.3.4.3. What institutions foster economic growth

1.3.5. 14. Savings, Investments, Loanable Funds

1.3.5.1. What is the loanable funds market

1.3.5.2. What factors shift the supply of loanable funds

1.3.5.3. What factors shift the demand for loanable funds

1.3.5.4. How do we apply the loanable funds market model

1.3.6. 15. Federal Reserve

1.3.6.1. What is money

1.3.6.2. What is the Fed

1.3.6.3. How is the money supply measured

1.3.6.4. How do banks create money

1.3.7. 16. Monetary Policy

1.3.7.1. What are the tools of monetary policy

1.3.7.2. What is the effect of monetary policy in the short run

1.3.7.3. Why doesn’t monetary policy always work

1.3.8. 17. Fiscal Policy

1.3.8.1. What is fiscal policy

1.3.8.2. How does the government tax

1.3.8.3. How does the government spend

1.3.8.4. How do budget deficits differ from debt

1.3.8.5. What are the shortcomings of fiscal policy

1.3.9. 18. International Economics

1.3.9.1. How does international trade help the economy

1.3.9.2. What are the effects of tariffs

1.3.9.3. Why do exchange rates matter

1.3.9.4. Why do exchange rates rise and fall

1.4. D. Personal Finance

1.4.1. What do you need to know about borrowing

1.4.2. how do interest rates affect borrowers

1.4.3. is it better to buy or rent a house

1.4.4. how do people save for retirement

2. Grading Scheme

2.1. Class participation 10%

2.1.1. Contextual: Willingness to participate and attentive to discussion

2.1.2. Innovative: There is willingness to test new ideas and comments are not confrontational.

2.1.3. Insightful: Comments are appropriate and indicates insightful analysis of case data

2.1.4. Relevant: Comments are relevant to current discussion and linked to comments of others

2.1.5. Supported: Comments clarify important aspects of earlier ideas and lead to clearer statement of relevant concepts and issues

2.2. Research Assignments 60%

2.2.1. Slides Presentation

2.2.1.1. Presentation is professionally done

2.2.1.2. Not more than 30 slides (20 minutes)

2.2.1.3. Prescribed presentation standards

2.2.2. Written Report

2.2.2.1. Prescribed report format

2.2.2.2. Report is consistent and effectively sells its recommendations

2.2.2.3. Report is not long, 2000 words max

2.2.2.4. Exhibits

2.2.2.4.1. Analyses in the exhibits are done correctly

2.2.2.4.2. Exhibits support and clarify key points

2.2.2.4.3. 3 to 7 exhibits

2.3. Assignments 30%

2.3.1. Case Analysis

2.3.1.1. Quality analysis

2.3.1.1.1. Major issues are addressed

2.3.1.1.2. Relevant tools are used properly

2.3.1.1.3. Assumptions for analysis are stated clearly

2.3.1.1.4. Causes of the problems are identified in the analysis

2.3.1.2. Recommendations

2.3.1.2.1. Criteria for selecting alternative recommendations are given

2.3.1.2.2. Criteria are appropriate

2.3.1.2.3. Plan of action is logical linked to the analysis

2.3.1.2.4. Plan of action is specific, complete and practical

2.3.1.2.5. Recommendations are likely to achieve intended results

2.3.1.3. Prescribed format

2.3.2. Essays

3. Learning Tasks

3.1. Oral & written reports

3.1.1. Substance & relevance of written report

3.1.2. Effectiveness of oral presentation

3.1.3. Compliance to prescribed standards