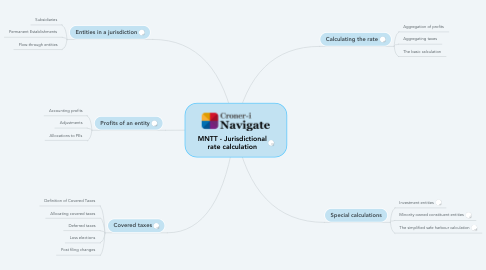

MNTT - Jurisdictional rate calculation

by Glyn Fullelove

1. Entities in a jurisdiction

1.1. Subsidiaries

1.2. Permanent Establishments

1.3. Flow-through entities

2. Covered taxes

2.1. Definition of Covered Taxes

2.2. Allocating covered taxes

2.3. Deferred taxes

2.4. Loss elections

2.5. Post filing changes

3. Special calculations

3.1. Investment entities

3.2. Minority owned constituent entities

3.3. The simplified safe harbour calculation

4. Profits of an entity

4.1. Accounting profits

4.2. Adjustments

4.3. Allocations to PEs

5. Calculating the rate

5.1. Aggregation of profits

5.2. Aggregating taxes

5.3. The basic calculation