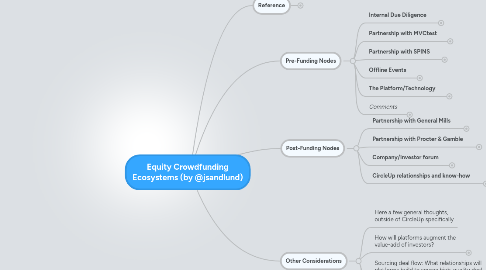

1. Pre-Funding Nodes

1.1. Internal Due Diligence

1.1.1. Draws on domain expertise to curate deal flow; advertises a 2% curation rate

1.1.2. Due diligence team consists of individuals with deep experience investing in the consumer product & retail space

1.2. Partnership with MVCtest

1.2.1. Sends samples to consumers across the country. Scores perception of the brand, both the price point and the quality of the product

1.2.2. Valuable data to the company that also augments investor due diligence

1.3. Partnership with SPINS

1.3.1. Provides nationwide retail sell-through data. Very expensive data for companies to purchase themselves — most companies wouldn't have access to it individually.

1.3.2. Valuable data to the company that also augments investor due diligence

1.4. Offline Events

1.4.1. Currently, selectively coordinating offline investor events.

1.5. The Platform/Technology

1.5.1. Making it efficient for investors to (i) discover; (ii) engage with; and (iii) invest in companies

1.5.1.1. Embedded pitch decks

1.5.1.2. Integrated scheduling (conference calls, etc.)

1.5.1.3. Investor Q&A forum

1.5.1.3.1. "Collective diligence" -- If one investor ask a question, all investors benefit

1.5.1.4. Integrated legal docs -- executed online

1.5.2. Crowdsourcing mechanism

1.5.2.1. Enables investors to vote on which companies, out of a pre-screened population, are listed next

1.5.2.2. (Distributing some of the pre-listing due-diligence to investors)

1.6. Comments

1.6.1. I believe the value of the platform/technology is becoming more commoditized by the day

1.6.2. Other critical nodes, which I'm unaware of, but surely exist, include relationships with individuals/companies that provide sources of deal flow

2. Post-Funding Nodes

2.1. Partnership with General Mills

2.1.1. Incubator days: provides valuable mentorship to companies

2.1.2. Growth/Exit Opportunities

2.2. Partnership with Procter & Gamble

2.2.1. Incubator days: provides valuable mentorship to companies

2.2.2. Growth/Exit Opportunities

2.3. Company/Investor forum

2.3.1. Allows for bilateral updates and communication; e.g. investors can make value-added introductions

2.4. CircleUp relationships and know-how

2.4.1. By nature of having previous investment experience in the industry, CircleUp is likely to have influential relationships with key industry participants, including buyers, suppliers, consultants and investors (important for follow-on financings)

3. Other Considerations

3.1. Here a few general thoughts, outside of CircleUp specifically

3.2. How will platforms augment the value-add of investors?

3.2.1. e.g. Pre-Funding: Aligning Company A with an Investor B because he/she has more relevant experience/relationships

3.2.2. e.g. Post-Funding: Fostering more meaningful investor communication/support by doing X,Y or Z

3.3. Sourcing deal flow: What relationships will platforms build to source high-quality deal flow?

3.4. Liquidating the marketplace: What relationships will platforms build to bring additional liquidity to the marketplace?

3.4.1. e.g. Angel Group: "Crowdfund $200k on X platform, and we'll come in for the remaining $300k"