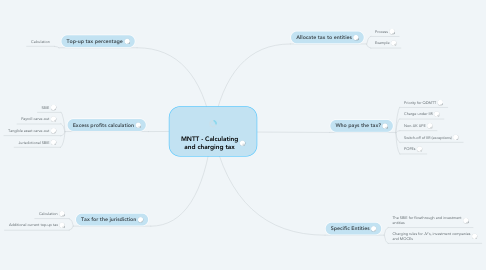

MNTT - Calculating and charging tax

by Glyn Fullelove

1. Top-up tax percentage

1.1. Calculation

2. Tax for the jurisdiction

2.1. Calculation

2.2. Additional current top-up tax

3. Who pays the tax?

3.1. Priority for QDMTT

3.2. Charge under IIR

3.3. Non-UK UPE

3.4. Switch-off of IIR (exceptions)

3.5. POPEs

4. Excess profits calculation

4.1. SBIE

4.2. Payroll carve-out

4.3. Tangible asset carve-out

4.4. Jurisdictional SBIE

5. Allocate tax to entities

5.1. Process

5.2. Example

6. Specific Entities

6.1. The SBIE for flowthrough and investment entities

6.2. Charging rules for JV's, investment companies and MOCEs