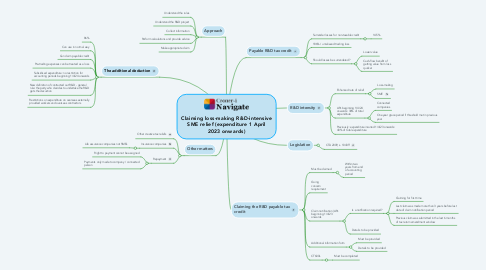

1. [Payable R&D tax credit](https://library.croneri.co.uk/cch_uk/btr/714-270)

1.1. Surrender losses for non-taxable credit

1.1.1. 14.5%

1.2. 186% / unrelieved trading loss

1.3. Should losses be surrendered?

1.3.1. Lower value

1.3.2. Cash-flow benefit of getting value from loss quicker

2. [R&D intensity](https://library.croneri.co.uk/cch_uk/btr/714-272)

2.1. Enhanced rate of relief

2.1.1. Loss-making

2.1.2. [SME](https://library.croneri.co.uk/po-heading-id_Z0BkqSA3eEijnCUtnT_cPw#po-heading-id_Z7-knQXGUkaufUek6-T9tA)

2.2. APs beginning 1/4/24 onwards: 30% of total expenditure

2.2.1. Connected companies

2.2.2. One year grace period if threshold met in previous year

2.3. Previously: expenditure incurred 1/4/23 onwards: 40% of total expenditure

3. Legislation

3.1. [CTA 2009, s. 1043ff](https://library.croneri.co.uk/cch_uk/btl/cta2009-it-pt-13-ch-2)

4. [Claiming the R&D payable tax credit](https://library.croneri.co.uk/cch_uk/btr/714-880)

4.1. Must be claimed

4.1.1. Within two years from end of accounting period

4.2. Going concern requirement

4.3. Claim notification (APs beginning 1/4/23 onwards

4.3.1. Is a notification required?

4.3.1.1. Claiming for first time

4.3.1.2. Last claim was made more than 3 years before last date of claim notification period

4.3.1.3. Previous claim was submitted in the last 6 months of tax return amendment window

4.3.2. Details to be provided

4.4. Additional information form

4.4.1. Must be provided

4.4.2. Details to be provided

4.5. CT600L

4.5.1. Must be completed

5. [The additional deduction](https://library.croneri.co.uk/cch_uk/btr/714-272)

5.1. 86%

5.2. Can use in normal way

5.3. Can claim payable credit

5.4. Pre-trading expenses can be treated as a loss

5.5. Subsidised expenditure: no restriction for accounting periods beginning 1/4/24 onwards

5.6. New definition of contracted out R&D - general rule: the party who decides to undertake the R&D gets the decuction

5.7. Restrictions on expenditure on overseas externally provided workers and overseas contractors

6. [Advising the client](https://library.croneri.co.uk/WKID-202404091055030163-94040858)

6.1. Understand the R&D project

6.2. Understand the rules

6.3. Collect information

6.4. Perform calculations and provide advice

6.5. Make appropriate claim

7. Other matters

7.1. [Other creative tax reliefs](https://library.croneri.co.uk/cch_uk/btr/companytax-creativeindustryenhanceddeductions)

7.2. [Insurance companies](https://library.croneri.co.uk/cch_uk/btr/714-695)

7.2.1. Life assurance companies not SMEs

7.3. [Repayment](https://library.croneri.co.uk/cch_uk/btr/714-270)

7.3.1. Right to payment cannot be assigned

7.3.2. Payments only made to company / connected person