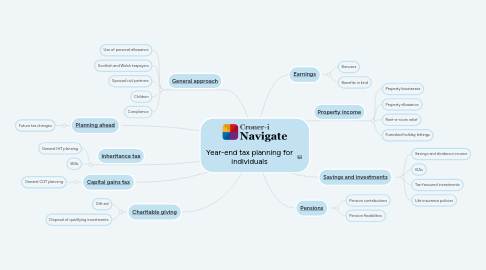

Year-end tax planning for individuals

by Laura Burrows

1. [Pensions](https://library.croneri.co.uk/po-heading-id_uu6DNqzMQUKr-kbIdA8UcA)

1.1. Pension contributions

1.2. Pension flexibilities

2. [Charitable giving](https://library.croneri.co.uk/po-heading-id_OvXsPj9h0Eu_AABdZifMdA)

2.1. Gift aid

2.2. Disposal of qualifying investments

3. [Inheritance tax](https://library.croneri.co.uk/po-heading-id_iovcimj2eEG5lap0pbxd-w)

3.1. General IHT planning

3.2. Wills

4. [Savings and investments](https://library.croneri.co.uk/po-heading-id_PrEkRdYUl0WRapkaFMHv0g)

4.1. Savings and dividence income

4.2. ISAs

4.3. Tax-favoured investments

4.4. Life insurance policies

5. [Capital gains tax](https://library.croneri.co.uk/po-heading-id_v1WklfN2HEaiilpsEieZ2Q)

5.1. General CGT planning

6. [Planning ahead](https://library.croneri.co.uk/po-heading-id_t0yuSEK7L0-FxXek0vKffw)

6.1. Future tax changes

7. [General approach](https://library.croneri.co.uk/po-heading-id_EOILd6Kn7kygVY0A5okrdg)

7.1. Use of personal allowance

7.2. Scottish and Welsh taxpayers

7.3. Spouse/civil partners

7.4. Children

7.5. Compliance

8. [Property income](https://library.croneri.co.uk/po-heading-id_yYtHNbbHtk-dkw-KQ4pHaA)

8.1. Property businesses

8.2. Property allowance

8.3. Rent-a-room relief

8.4. Furnished holiday lettings

9. [Earnings](https://library.croneri.co.uk/po-heading-id_jIL3yJlIOE6HN3WXB9i6-A)

9.1. Bonuses

9.2. Benefits in kind