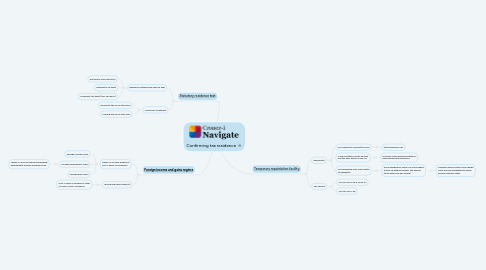

1. [Statutory residence test](https://library.croneri.co.uk/po-heading-id_5woTdEID20u9CFmuSBXNag)

1.1. Residence determined year by year

1.1.1. Automatic overseas tests

1.1.2. Automatic UK tests

1.1.3. Sufficient ties tests (the 'fall-back')

1.2. 'Split year' treatment

1.2.1. Moving to the UK in a tax year

1.2.2. Leaving the UK in a tax year

2. [Foreign income and gains regime](https://library.croneri.co.uk/WKID-202506021436560329-76831772)

2.1. Relief on income & gains in first 4 years of residence

2.1.1. Foreign income claim

2.1.2. Foreign employment claim

2.1.2.1. Lower of: 30% of relevant qualifying employment income and £300,000

2.1.3. Foreign gain claim

2.2. 'Qualifying new residents'

2.2.1. First 4 years of residence, after 10 years of non-residence

3. [Temporary repatriation facility](https://library.croneri.co.uk/WKID-202506021436560329-76831772)

3.1. Availability

3.1.1. UK resident in relevant tax year

3.1.1.1. Determined by SRT

3.1.2. Used remittance basis at least one tax year before 2025-26

3.1.2.1. Includes cases where remittance basis applied automatically

3.1.3. Has qualifying overseas capital to designate

3.1.3.1. Once designated, funds can be brought to the UK without further tax charge (even after TRF has ended)

3.1.3.1.1. Overseas funds used to pay charge must also be designated to avoid paying usual tax rates

3.2. TRF charge

3.2.1. 12% for 2025-26 & 2026-27

3.2.2. 15% for 2027-28