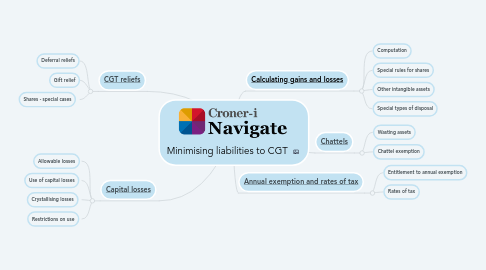

Minimising liabilities to CGT

by stephanie webber

1. [CGT reliefs](https://library.croneri.co.uk/po-heading-id_RJvlddS4UE-Grrm0ahO4RA)

1.1. Deferral reliefs

1.2. Gift relief

1.3. Shares - special cases

2. [Capital losses](https://library.croneri.co.uk/po-heading-id_KOBO-c8TOEuh4eyxuP6_iw)

2.1. Allowable losses

2.2. Use of capital losses

2.3. Crystallising losses

2.4. Restrictions on use

3. [Calculating gains and losses](https://library.croneri.co.uk/po-heading-id_DxzKt7LdG0C6ifreli6ZZQ)

3.1. Computation

3.2. Special rules for shares

3.3. Other intangible assets

3.4. Special types of disposal

4. [Chattels](https://library.croneri.co.uk/po-heading-id_gRSOTzHNRE2nW3nX9jwcLQ)

4.1. Wasting assets

4.2. Chattel exemption

5. [Annual exemption and rates of tax](https://library.croneri.co.uk/po-heading-id_LYz3_wd_0k-1UxMB-nmoig)

5.1. Entitlement to annual exemption

5.2. Rates of tax