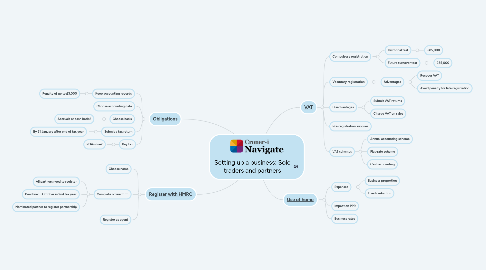

Setting up a business: Sole traders and partners

by Stephen Relf

1. [Obligations](https://library.croneri.co.uk/po-heading-id_wthnkMkbRkCpyHErg0-Drg)

1.1. Keep accounting records

1.1.1. Penalty of up to £3,000

1.2. Choose accounting date

1.3. Choose basis

1.3.1. Accruals or cash basis?

1.4. Submit a tax return

1.4.1. By 31 January after end of tax year

1.5. Pay tax

1.5.1. POAs due?

2. [Register with HMRC](https://library.croneri.co.uk/po-heading-id_JqOzXG-6_kaP3o4NrI09XQ)

2.1. Choose name

2.2. Complete online form

2.2.1. All partners need to register

2.2.2. Deadline: 5 October in 2nd tax year

2.2.3. Nominated partner to register partnership

2.3. Register as agent

3. [VAT](https://library.croneri.co.uk/po-heading-id_bBdYmtcmGkilyHRRvHjHgA)

3.1. Compulsory registration

3.1.1. Historical test

3.1.1.1. £85,000

3.1.2. Future turnover test

3.1.2.1. £85,000

3.2. Voluntary registration

3.2.1. Advantages

3.2.1.1. Recover VAT

3.2.1.2. Avoid penalty for late registration

3.3. Disadvantages

3.3.1. Submit VAT returns

3.3.2. Charge VAT on sales

3.4. Pre-registration supplies

3.5. VAT schemes

3.5.1. Annual accounting scheme

3.5.2. Flat-rate scheme

3.5.3. Cash accounting

4. [Use of home](https://library.croneri.co.uk/po-heading-id_Ufr_JgrsDEOQHAEFSqpqZQ)

4.1. Expenses

4.1.1. Business proportion

4.1.2. Fixed deduction