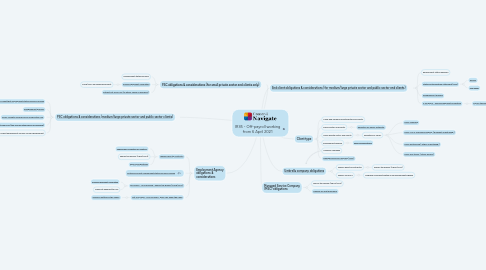

1. [End client obligations & considerations (for medium/large private sector and public sector end clients)](https://library.croneri.co.uk/po-heading-id_gFFMarAYk0G-xUSp-CWXVw)

1.1. Employment status decision

1.2. [Status Determination Statement (SDS)](https://library.croneri.co.uk/cch_uk/btr/408-355)

1.2.1. [Worker](https://library.croneri.co.uk/cch_uk/btr/408-304?highlight=1)

1.2.2. [Fee-payer](https://library.croneri.co.uk/cch_uk/btr/408-330?highlight=1)

1.3. [Disagreement process](https://library.croneri.co.uk/cch_uk/btr/408-360?highlight=1)

1.4. [If fee payer - Deemed payment calculation](https://library.croneri.co.uk/cch_uk/btr/408-340?highlight=1)

1.4.1. [Payroll the worker (PAYE/NICs)](https://library.croneri.co.uk/cch_uk/btr/408-345)

2. [Umbrella company obligations](https://library.croneri.co.uk/po-heading-id_3zwzsql-zUuNZqvtm84z2Q)

2.1. Worker directly contracts?

2.1.1. Payroll the worker (PAYE/NICs)

2.2. Worker via PSC?

2.2.1. Umbrella company treated as an Employment Agency

3. Client type

3.1. Large and medium private sector end clients

3.2. Public sector end clients

3.2.1. [Definition of 'public authority'](https://library.croneri.co.uk/cch_uk/btr/408-220?highlight=1)

3.3. Small private sector end clients

3.3.1. Definition of 'small'

3.3.1.1. [Small company](https://library.croneri.co.uk/cch_uk/btr/408-311)

3.3.1.2. [Small LLP or overseas company ('Relevant undertaking')](https://library.croneri.co.uk/cch_uk/btr/408-312)

3.3.1.3. [Small partnership ('Other undertaking')](https://library.croneri.co.uk/cch_uk/btr/408-313)

3.3.1.4. [Small sole trader ('Other person')](https://library.croneri.co.uk/cch_uk/btr/408-314)

3.4. Employment Agency

3.4.1. [Agency Regulations](https://library.croneri.co.uk/cobweb-bif/cobweb-BIF-2645?highlight=1)

3.5. Umbrella company

3.6. [Managed Service Company (MSC)](https://library.croneri.co.uk/cch_uk/btr/408-550)

4. Managed Service Company (MSC) obligations

4.1. Payroll the worker (PAYE/NICs)

4.2. [Transfer of debt provisions](https://library.croneri.co.uk/cch_uk/btr/408-900)

5. [PSC obligations & considerations (for small private sector end clients only)](https://library.croneri.co.uk/po-heading-id__uWqBT4bw0KiP9wwe9h2Ug)

5.1. Employment status decision

5.2. [Deemed payment calculation](https://library.croneri.co.uk/cch_uk/btr/407-660?highlight=1)

5.2.1. PAYE/NICs on deemed payment

5.3. [Extract net from PSC (as either salary or dividend)](https://library.croneri.co.uk/cch_uk/btr/407-710?highlight=1)

6. [PSC obligations & considerations (medium/large private sector and public sector clients)](https://library.croneri.co.uk/po-heading-id_K-Wkoncrg0uiB79aWgbBDw)

6.1. [Notify agency/end client that employment status decision needed](https://library.croneri.co.uk/cch_uk/btr/408-306)

6.2. [Disagreement process](https://library.croneri.co.uk/cch_uk/btr/408-360?highlight=1)

6.3. [Gross receipts excluded from Corporation Tax](https://library.croneri.co.uk/cch_uk/btl/cta2009-it-s-141a?highlight=1)

6.4. [Extract net from PSC (tax-free as either salary or dividend)](https://library.croneri.co.uk/cch_uk/hmrctaxm/esm-esm10030)

6.5. Owner/director to report employment income via Self Assessment

7. Employment Agency obligations & considerations

7.1. [Worker directly contacts?](https://library.croneri.co.uk/cch_uk/btr/400-defi-7)

7.1.1. [Supervision, Direction or Control?](https://library.croneri.co.uk/cch_uk/btr/407-500?highlight=1)

7.1.2. Payroll the worker (PAYE/NICs)

7.1.3. [Agency Regulations](https://library.croneri.co.uk/cobweb-bif/cobweb-BIF-2645?highlight=1)

7.2. [Notify end client employment status decision needed](https://library.croneri.co.uk/cch_uk/btr/408-335?highlight=1)

7.3. [Fee-payer - SDS received - payroll the worker (PAYE/NICs)](https://library.croneri.co.uk/cch_uk/btr/408-340?highlight=1)

7.3.1. [Deemed payment calculation](https://library.croneri.co.uk/cch_uk/btr/408-340?highlight=1)

7.3.2. Make net payment to PSC

7.4. [Not fee-payer - SDS received - pass SDS down the chain](https://library.croneri.co.uk/cch_uk/btr/408-335)

7.4.1. [Offshore entities in the chain?](https://library.croneri.co.uk/cch_uk/btr/408-330)