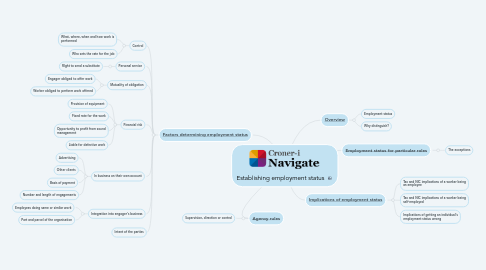

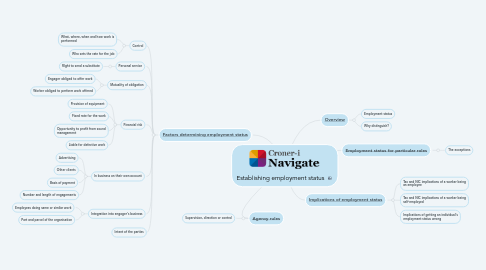

Establishing employment status

von Meg Wilson

1. [Overview](https://library.croneri.co.uk/po-heading-id_mTMmiJUo70SFnYmetqzzzQ)

1.1. Employment status

1.2. Why distinguish?

2. [Implications of employment status](https://library.croneri.co.uk/po-heading-id_RscS0cSt2kmNJ4px78u5uA)

2.1. Tax and NIC implications of a worker being an employee

2.2. Tax and NIC implications of a worker being self-employed

2.3. Implications of getting an individual's employment status wrong

3. [Factors determining employment status]( https://library.croneri.co.uk/po-heading-id_5D5Hhb0Bt0ym5WiIIRKrRg )

3.1. Control

3.1.1. What, where, when and how work is performed

3.1.2. Who sets the rate for the job

3.2. Personal service

3.2.1. RIght to send a substitute

3.3. Mutuality of obligation

3.3.1. Engager obliged to offer work

3.3.2. Worker obliged to perform work offered

3.4. Financial risk

3.4.1. Provision of equipment

3.4.2. Fixed rate for the work

3.4.3. Opportunity to profit from sound management

3.4.4. Liable for defective work

3.5. In business on their own account

3.5.1. Advertising

3.5.2. Other clients

3.5.3. Basis of payment

3.5.4. Number and length of engagements

3.6. Integration into engager's business

3.6.1. Employees doing same or similar work

3.6.2. Part and parcel of the organisation