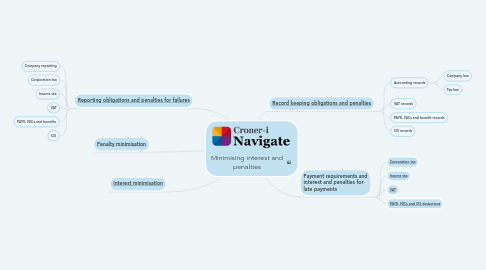

Minimising interest and penalties

von Meg Wilson

1. [Reporting obligations and penalties for failures](https://library.croneri.co.uk/po-heading-id_pU2O1kvZiUGKnAklZaLU_A)

1.1. Company reporting

1.2. Corporation tax

1.3. Income tax

1.4. VAT

1.5. PAYE, NICs and benefits

1.6. CIS

2. [Penalty minimisation](https://library.croneri.co.uk/po-heading-id_0TKOHbBBtUOwjL5LEjn95A)

3. [Interest minimisation](https://library.croneri.co.uk/po-heading-id_6-ZNnwFc-Uma9xWsu8o1Jg)

4. [Record keeping obligations and penalties](https://library.croneri.co.uk/po-heading-id_qjiotQd1fEiUMLYOJAYEEQ)

4.1. Accounting records

4.1.1. Company law

4.1.2. Tax law