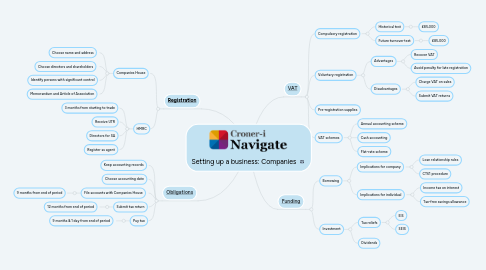

1. [Registration](https://library.croneri.co.uk/po-heading-id_1b6F4DD0OkCeyXwiDCrLcw)

1.1. Companies House

1.1.1. Choose name and address

1.1.2. Choose directors and shareholders

1.1.3. Identify persons with significant control

1.1.4. Memorandum and Article of Association

1.2. HMRC

1.2.1. 3 months from starting to trade

1.2.2. Receive UTR

1.2.3. Directors for SA

1.2.4. Register as agent

2. [Obligations](https://library.croneri.co.uk/po-heading-id_36weoqQ13UahVQfiDpXDrw)

2.1. Keep accounting records

2.2. Choose accounting date

2.3. File accounts with Companies House

2.3.1. 9 months from end of period

2.4. Submit tax return

2.4.1. 12 months from end of period

2.5. Pay tax

2.5.1. 9 months & 1 day from end of period

3. [VAT](https://library.croneri.co.uk/po-heading-id_zGQyQdU_Lkiy7gznKeCA9Q)

3.1. Compulsory registration

3.1.1. Historical test

3.1.1.1. £85,000

3.1.2. Future turnover test

3.1.2.1. £85,000

3.2. Voluntary registration

3.2.1. Advantages

3.2.1.1. Recover VAT

3.2.1.2. Avoid penalty for late registration

3.2.2. Disadvantages

3.2.2.1. Charge VAT on sales

3.2.2.2. Submit VAT returns

3.3. Pre-registration supplies

3.4. VAT schemes

3.4.1. Annual accounting scheme

3.4.2. Cash accounting

3.4.3. Flat-rate scheme

4. [Funding](https://library.croneri.co.uk/po-heading-id_yH4XR3TEgESy0AKR5zPHgg)

4.1. Borrowing

4.1.1. Implications for company

4.1.1.1. Loan relationship rules

4.1.1.2. CT61 procedure

4.1.2. Implications for individual

4.1.2.1. Income tax on interest

4.1.2.2. Tax-free savings allowance

4.2. Investment

4.2.1. Tax reliefs

4.2.1.1. EIS

4.2.1.2. SEIS

4.2.2. Dividends