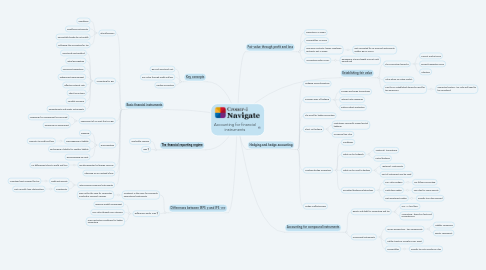

1. [Key concepts](https://library.croneri.co.uk/po-heading-id_0DLUfBiIAU2LzyiXRsJZFw)

1.1. BFI and amortised cost

1.2. Fair value through profit and loss

1.3. Hedge accounting

2. [Basic financial instruments](https://library.croneri.co.uk/po-heading-id__qBStu6AQkurLNPW8jNHIg)

2.1. Identifying BFI

2.1.1. Conditions

2.1.2. Qualifying Instruments

2.1.3. Convertible bonds do not qualify

2.1.4. Following the accounting for tax

2.2. Accounting for BFI

2.2.1. Amortised Cost Method

2.2.2. Initial Recognition

2.2.3. Financing transactions

2.2.4. Subsequent measurement

2.2.5. Effective interest rate

2.2.6. Short term items

2.2.7. Variable Coupons

2.2.8. Commitments and equity instruments

2.3. Impairment of an asset that is a BFI

2.3.1. Assessing if an impairment has occurred

2.3.2. Measuring an impairment

2.4. Derecognition

2.4.1. Meaning

2.4.2. Derecognising a liability

2.4.2.1. Amounts to profit and loss

2.4.3. Exchanging a liability for another liability

2.4.4. Derecognising an asset

2.5. BFI denominated in foreign currency

2.5.1. FX differences taken to profit and loss

2.6. Choosing FVTPL instead of BFI

2.7. Inter-company Financial Instruments

2.7.1. Debt Instruments

2.7.1.1. Amortised cost required for tax

2.7.2. Investments

2.7.2.1. Not normally loan relationships

3. [The financial reporting regime](https://library.croneri.co.uk/po-heading-id_V3LNe2BhL0GlR_DXjJ0dGA)

3.1. Applicable regimes

3.2. IFRS 9

4. [Differences between IRFS 9 and IFS 102](https://library.croneri.co.uk/po-heading-id_cO1vQaCoSU6synL-9kQ19g)

4.1. Treatment is the same for commonly encountered instruments

4.1.1. May not be the case for corporates involved in Financial Services

4.2. Differences under IFRS 9

4.2.1. Business model requirement

4.2.2. Fair Value through OCI category

4.2.3. More restrictive conditions for hedge accounting

5. [Fair value through profit and loss](https://library.croneri.co.uk/po-heading-id_yDIy66N2a0eUi13_TtgC7Q)

5.1. Derivatives -in scope

5.2. Convertibles -in scope

5.3. Insurance contracts, leases, employee contracts; not in scope

5.3.1. Not accounted for as Financial Instruments, neither BFI or FVTPL

5.4. Accounting under FVTPL

5.4.1. Remeasure at arms-length price at each period end

6. [Establishing fair value](https://library.croneri.co.uk/po-heading-id_q-ZHtJnWP0eMhte6DHNqXA)

6.1. The accounting hierarchy

6.1.1. Current market price

6.1.2. Recent transaction price

6.1.3. Valuation

6.2. Value when no active market

6.3. Can the FV established always be used for tax purposes?

6.3.1. Connected parties - tax rules will need to be considered

7. [Hedging and hedge accounting](https://library.croneri.co.uk/po-heading-id_5WMGuzNI5Em7ck_vV619Hw)

7.1. Hedging using derivatives

7.2. Common uses of hedging

7.2.1. Foreign exchange transactions

7.2.2. Interest rate exposures

7.2.3. Balance sheet protection

7.3. The need for hedge accounting

7.4. Short cut hedging

7.4.1. Limitations, especially around partial hedging

7.4.2. No special tax rules

7.5. Applying hedge accounting

7.5.1. Conditions

7.5.2. What can be hedged?

7.5.2.1. "External" transactions

7.5.2.2. Partial hedging

7.5.3. What can be used to hedge?

7.5.3.1. "External" instruments

7.5.3.2. Part of instrument may be used

7.5.4. Permitted hedging relationships

7.5.4.1. Fair Value Hedges

7.5.4.1.1. Tax follows accounting

7.5.4.2. Cash Flow Hedge

7.5.4.2.1. Tax rules for some aspects

7.5.4.3. Net Investment Hedge

7.5.4.3.1. Specific tax rules required

7.6. Hedge Ineffectiveness

8. [Accounting for compound instruments](https://library.croneri.co.uk/po-heading-id_bK4lpLYSqEiTnfKFPwxJ2g)

8.1. Equity and debt for accounting and tax

8.1.1. Tax - a "hard line"

8.1.2. Accounting - based on facts and circumstances

8.2. Compound instruments

8.2.1. Issuers perspective - two components

8.2.1.1. Liability componen

8.2.1.2. Equity component

8.2.2. Holder treats as a single FVTPL asset

8.2.3. Convertibles

8.2.3.1. Specific tax anti-avoidance rules