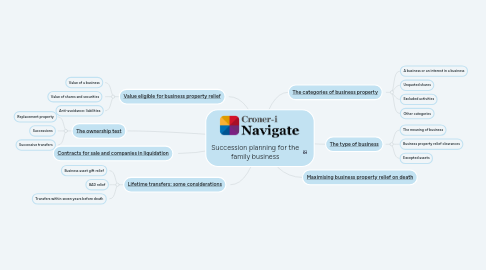

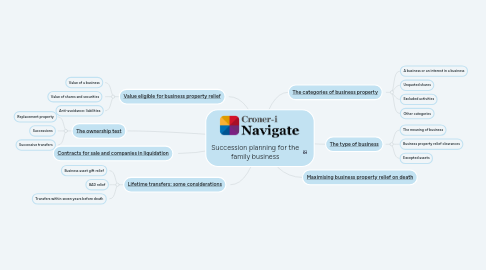

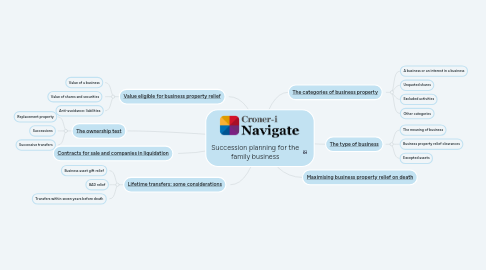

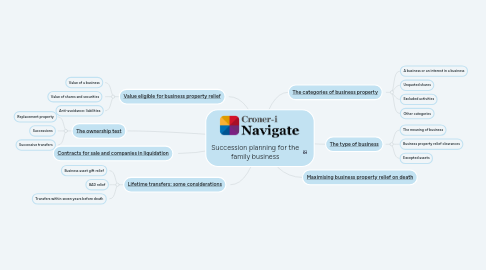

Succession planning for the family business

by stephanie webber

1. [Value eligible for business property relief](https://library.croneri.co.uk/po-heading-id_4ZQGP1C4CUCvzPKTq0rq6A)

1.1. Value of a business

1.2. Value of shares and securities

1.3. Anti-avoidance: liabilities

2. [The ownership test](https://library.croneri.co.uk/po-heading-id_C_PwmGnawkyy4DcaFt-nDA)

2.1. Replacement property

2.2. Successions

2.3. Successive transfers

3. [Lifetime transfers: some considerations](https://library.croneri.co.uk/po-heading-id_MMbd92BbkEeNRSqv91rhww)

3.1. Business asset gift relief

3.2. BAD relief

3.3. Transfers within seven years before death

4. [The categories of business property](https://library.croneri.co.uk/po-heading-id_8Wr_YuLBQ0WTAi_g-2bbhw)

4.1. A business or an interest in a business

4.2. Unquoted shares

4.3. Excluded activities

4.4. Other categories

5. [Maximising business property relief on death](https://library.croneri.co.uk/po-heading-id_ZDwQIRfA9UiX9_vV8Ic88w)

6. [The type of business](https://library.croneri.co.uk/po-heading-id_87m8r7CRH0isA1qwLnKoOQ)

6.1. The meaning of business

6.2. Business property relief clearances

6.3. Excepted assets

7. [Contracts for sale and companies in liquidation](https://library.croneri.co.uk/po-heading-id_Qo8uGbm-J0ueOwq6P4Xlrw)