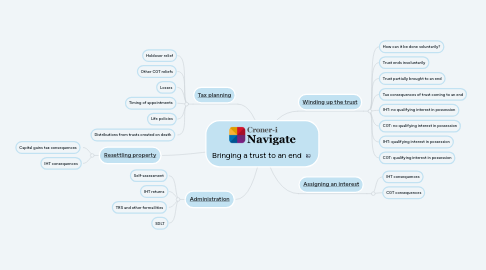

Bringing a trust to an end

by stephanie webber

1. [Tax planning](https://library.croneri.co.uk/WKID-202310171541580425-98211717)

1.1. Holdover relief

1.2. Other CGT reliefs

1.3. Losses

1.4. Timing of appointments

1.5. Life policies

1.6. Distributions from trusts created on death

2. [Resettling property](https://library.croneri.co.uk/WKID-202310171541580409-40417269)

2.1. Capital gains tax consequences

2.2. IHT consequences

3. [Administration](https://library.croneri.co.uk/WKID-202310171541580478-87458890)

3.1. Self-assessment

3.2. IHT returns

3.3. TRS and other formailities

3.4. SDLT

4. [Winding up the trust](https://library.croneri.co.uk/WKID-202310171541580271-84920799)

4.1. How can it be done voluntarily?

4.2. Trust ends involuntarily

4.3. Trust partially brought to an end

4.4. Tax consequences of trust coming to an end

4.5. IHT: no qualifying interest in possession

4.6. CGT: no qualifying interest in possession

4.7. IHT: qualifying interest in possession

4.8. CGT: qualifying interest in possession

5. [Assigning an interest](https://library.croneri.co.uk/WKID-202310171541580379-61038584)

5.1. IHT consequences

5.2. CGT consequences