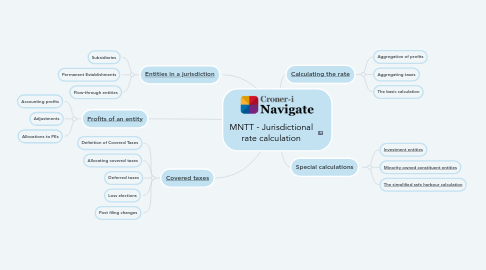

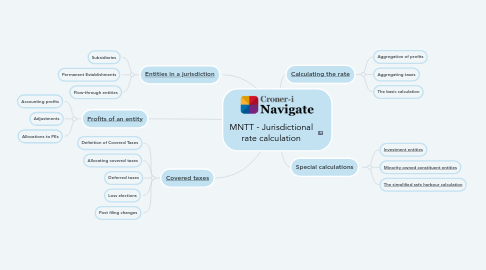

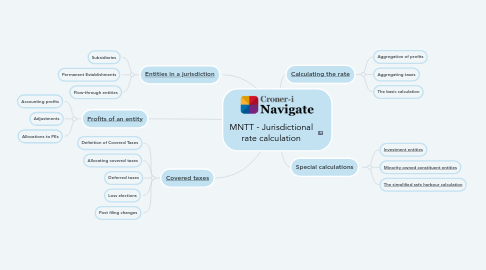

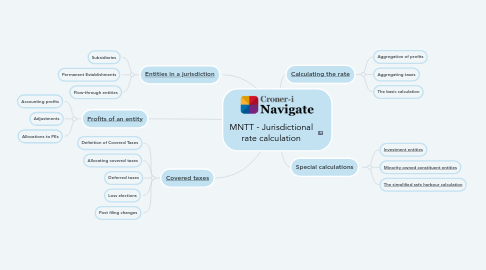

MNTT - Jurisdictional rate calculation

by Martin Jackson

1. [Entities in a jurisdiction](https://library.croneri.co.uk/WKID-202312141603380174-45999658)

1.1. Subsidiaries

1.2. Permanent Establishments

1.3. Flow-through entities

2. [Profits of an entity](https://library.croneri.co.uk/WKID-202401231133040811-98578695)

2.1. Accounting profits

2.2. Adjustments

2.3. Allocations to PEs

3. [Covered taxes](https://library.croneri.co.uk/WKID-202401251548520961-09852538)

3.1. Definition of Covered Taxes

3.2. Allocating covered taxes

3.3. Deferred taxes

3.4. Loss elections

3.5. Post filing changes

4. [Calculating the rate](https://library.croneri.co.uk/WKID-202402221455130870-90229943)

4.1. Aggregation of profits

4.2. Aggregating taxes

4.3. The basic calculation

5. Special calculations

5.1. [Investment entities](https://library.croneri.co.uk/WKID-202402221513230491-52278485)

5.2. [Minority owned constituent entities](https://library.croneri.co.uk/WKID-202402221536000639-77047633)

5.3. [The simplified safe harbour calculation](https://library.croneri.co.uk/WKID-202402221622080049-88341127)