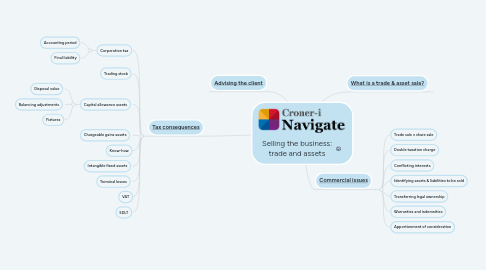

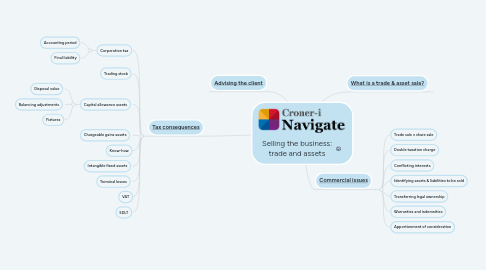

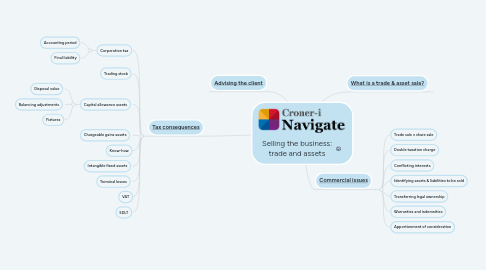

Selling the business: trade and assets

por Paul Davies

1. [Tax consequences](https://library.croneri.co.uk/po-heading-id_hHpJK_mtEkCSNGH9ybjh_g?section=319261)

1.1. Corporation tax

1.1.1. Accounting period

1.1.2. Final liability

1.2. Trading stock

1.3. Capital allowance assets

1.3.1. Disposal value

1.3.2. Balancing adjustments

1.3.3. Fixtures

1.4. Chargeable gains assets

1.5. Know-how

1.6. Intangible fixed assets

1.7. Terminal losses

1.8. VAT

1.9. SDLT

2. [What is a trade & asset sale?](https://library.croneri.co.uk/po-heading-id_MH0ZYkOoukihG85By6BNow?section=319261)

3. [Advising the client](https://library.croneri.co.uk/po-heading-id_0I-bEYG00EWRWrI5YLiVFg?section=319261)

4. [Commercial issues](https://library.croneri.co.uk/po-heading-id_vfsT-mPcYUiBT4bT8btPLw)

4.1. Trade sale v share sale

4.2. Double taxation charge

4.3. Conflicting interests

4.4. Identifying assets & liabilities to be sold

4.5. Transferring legal ownership

4.6. Warranties and indemnities

4.7. Apportionment of consideration