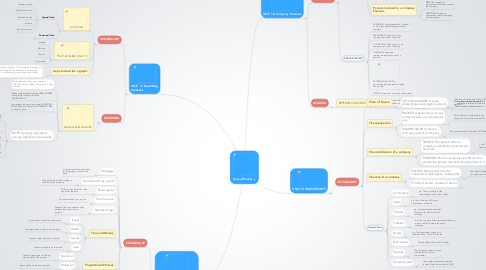

1. UNIT. 17 Describing Statistics

1.1. VOCABULARY

1.1.1. Line Chart

1.1.1.1. Upward Trend

1.1.1.1.1. Steady increase

1.1.1.1.2. Slight Fluctuations

1.1.1.1.3. Reached a peak

1.1.1.1.4. Increase

1.1.1.1.5. Signs of recovery

1.1.1.2. Downward Trend

1.1.1.2.1. Fall

1.1.1.2.2. Dipped slightly

1.1.1.2.3. Fell Sharply

1.1.1.2.4. Declined

1.1.1.2.5. Decrease

1.1.2. Pie Chart & Bar Chart

1.1.2.1. Formed

1.1.2.2. Made up

1.1.2.3. Came to

1.1.2.4. Constituted

1.1.3. steps to describe a graph:

1.1.3.1. 1.Identify the type of graph 2. Describe the information is represent in the graphic. 3. Remember in bar and pay chart I need to describe the graph of highest to lowest percentage.

1.2. GRAMMAR

1.2.1. Adjectives & Adverbs

1.2.1.1. Adjectives: describe a noun / Adverd: Modifies the verb (when, where, how, in what manner).

1.2.1.2. Trends can be described using VERB+ADVERB. Example: The share price ROSE DRAMATICALLY .

1.2.1.3. I can express the same idea using ADJECTIVE + NOUN. Example: There was A DRAMATIC RISE in the share price.

1.2.1.4. NOTE: Spelling rules about turning adjectives into adverbs.

1.2.1.4.1. Most adjectives add LY to form the adverb. e.g Sharp - Sharply

1.2.1.4.2. Adjectives ending in CONSONANT + Y change to I before adding LY. e.g Happy - Happily

1.2.1.4.3. Adjectives ending in IC add ALLY. e.g. Political - Politically

1.2.1.4.4. Adjectives ending in L add another L before LY. e.g. Beautiful - Beautifully

1.2.1.4.5. Adjectives ending in BLE add BLY. e.g. Terrible - Terribly.

2. UNIT 20. Starting up

2.1. VOCABULARY

2.1.1. Mortgage

2.1.1.1. To start my new business I have to mortgage my house to the bank.

2.1.2. Provide funding/ capital

2.1.2.1. My partnership provide funding to start the shoes company.

2.1.3. Raise capital

2.1.3.1. With the loan bank I can raise capital for the store.

2.1.4. Secure a loan

2.1.4.1. As a secured loan I put my car.

2.1.5. Business angel

2.1.5.1. Dragons Den are business angel, because they invest in new projects.

2.1.6. Time and Money

2.1.6.1. Invest

2.1.6.1.1. I invest time in my new house project.

2.1.6.2. Waste

2.1.6.2.1. My sister wasted money in her company.

2.1.6.3. Spend

2.1.6.3.1. I spend a great time with my family.

2.1.6.4. Save

2.1.6.4.1. I have to save time for this week.

2.1.7. Prepositional Phrases

2.1.7.1. Spend on

2.1.7.1.1. I have to spend time on design new models for the project.

2.1.7.2. Waste on

2.1.7.2.1. I waste money on the new company.

2.1.7.3. Invest in

2.1.7.3.1. I´m going to invest in cars.

2.1.8. Phrases

2.1.8.1. Flood with

2.1.8.1.1. Mexico market has been flooded with commodities imported from China.

2.1.8.2. Pour down

2.1.8.2.1. We need to pour down all the money in this company.

2.1.8.3. Pump into

2.1.8.3.1. Carlos Slim has pumped a lot of money into his companies.

2.1.8.4. Tap into

2.1.8.4.1. USA has tapped into the economy of Mexico for the last decade.

2.2. GRAMMAR

2.2.1. Which/ Who/That/Where Clauses

2.2.1.1. WHO/ THAT

2.2.1.1.1. People

2.2.1.2. THAT / WHICH

2.2.1.2.1. Things

2.2.1.3. WHERE

2.2.1.3.1. Places

2.2.1.4. WHOSE

2.2.1.4.1. Possesives

2.2.1.5. WHEN

2.2.1.5.1. Time

3. UNIT 18. Company Finances

3.1. VOCABULARY

3.1.1. FINANCIAL TERMS

3.1.1.1. Costs of a company

3.1.1.1.1. EXPENDITURE: The total amount of money that an organisation spends on something.

3.1.1.1.2. TO OVERSPEND: To spend more than you originally planned in your budget.

3.1.1.1.3. OVERHEADS: The costs of running the company e.g. rent, electricity, water billis, etc.

3.1.1.2. Profits of a company

3.1.1.2.1. TO BREAK EVEN: To earn enough money to pay for the costs of running the company but no more (no profit is made)

3.1.1.2.2. OPERATING PROFIT: The profit which comes from a company's usual activities of providing goods or services.

3.1.1.2.3. REVENUE: The money that a company earns from its sales.

3.1.1.2.4. GROSS PROFIT: How much a company earns before certain costs and taxes are deducted.

3.1.1.2.5. NET PROFIT: How much a company earns after all the costs and taxes are deducted.

3.1.1.3. Financial situation of a company

3.1.1.3.1. TO GO BANKRUPT: To legally stop doing business and close a company because of financial losses .

3.1.1.4. Persons involved in a company finances

3.1.1.4.1. DEBTOR: A person or organisation that owes money to the company.

3.1.1.4.2. CREDITOR: A person or organisation that the company owes money to.

3.1.2. FINANCIAL REPORT

3.1.2.1. SUBSIDIARY: A company which is owned, or more that 50% owned, by another company.

3.1.2.2. TAKEOVER: The buying of one company by another company.

3.1.2.3. ACQUISITION: The buying of one company by another company.

3.1.2.4. CASHFLOW: Payments coming into and going out of a business

3.1.2.5. RETURN ON SALES: The percentage that is earned by selling the product.

3.1.2.6. DEFICIT: An amount of money that is owed.

3.2. READING

3.2.1. REFERENCE WORDS

3.2.1.1. These are words we use instead of the names of people, things, or ideas already mentioned in the text.

3.2.1.1.1. EXAMPLE

4. UNIT 19. INVESTMENTS

4.1. VOCABULARY

4.1.1. Place of finance

4.1.1.1. STOCK EXCHANGE: A place where shares are bought and sold.

4.1.1.1.1. e.g. The most famous stock exchange is located in New York.

4.1.2. Financial person

4.1.2.1. BROKER: A person who can buy and sell shares in a company for you.

4.1.2.1.1. The broker has to negotiate to buy cheap shares for others companies.

4.1.2.2. SHAREHOLDER: Someone who owns part of a company.

4.1.2.2.1. The new shareholder of Apple is Bill Gates.

4.1.3. Financial division of a company

4.1.3.1. SHARES: The parts in which a company is divided so investors can buy them

4.1.3.1.1. Coca Cola Company put on sales shares to increase new shareholders.

4.1.3.2. DIVIDEND: Part of a company's profits which is paid to the people who have bought shares in it.

4.1.3.2.1. With the profits for this month we going to have a good dividend.

4.1.4. Finances of a company

4.1.4.1. CAPITAL: Money which can be invested in a business to make profits

4.1.4.1.1. The capital increse 10% now we can buy a new machinery.

4.1.4.2. STOCK: A certain number of shares

4.1.4.2.1. Company stock will be sold by the broker in the New York Stock exchange.

4.1.5. Financial Terms

4.1.5.1. Commodity

4.1.5.1.1. e.g. The commodity for the company have risen in the market.

4.1.5.2. Stake

4.1.5.2.1. e.g. Carlos Slim has 60% stake in the finances of Mexico.

4.1.5.3. Floated

4.1.5.3.1. e.g. Last year Facebook started floated on the New York stock exchange.

4.1.5.4. Flotation

4.1.5.4.1. e.g. The company flotation was excellent now we can sell the shares in the stock exchange.

4.1.5.5. Bonds

4.1.5.5.1. e.g. The government bonds rose yesterday after a fall in USA shares.

4.1.5.6. Bull market

4.1.5.6.1. Facebook has shares in bull market.

4.1.5.7. Equities

4.1.5.7.1. The company equities increase with the sell of our new commodities.

4.1.5.8. Dividend yield

4.1.5.8.1. The company shares are attractive for their high dividend yield of 6.3%.