1. Challenges

1.1. Gender issues

1.1.1. Women

1.1.1.1. micro-finance empowered to take a more prominent role in family

1.1.1.2. * HIV/Aids contributing factor to seek microcredit loans to use income for the health /education

1.1.1.3. Need source an income from where there had been a death in the family

1.1.1.4. often forced to hand over their loans to the men in the family, who subsequently use it for their own purposes

1.1.1.5. Tend to fear taking loans out for the consequences of missing a payment and being sent to jail or losing their homes.

1.1.1.5.1. This tends to make them a more reliable investment to MFIs.

1.1.2. Men

1.1.2.1. Involvement of the men as they have a stake in the properties that are required as capital for any loans.

1.1.2.2. Better engagement of men could be obtained by more involvement in the MSF.

1.2. Feasibility study

1.2.1. Projects have failed in the past due to a situational analysis not followed by a thorough feasibility study to address all the technical, technological, environmental, social, economic, legal, and political aspects

1.2.1.1. Baseline survey may profile the status quo in the targeted community or settlement in terms of:

1.2.1.1.1. Demographic, health, and income profile

1.2.1.1.2. Local representation and leadership structures

1.2.1.1.3. Water and sanitation facilities

1.2.1.1.4. Settlement Profile

1.2.1.1.5. Growth and development trajectory

1.2.1.2. Technical assessment to establish which toilet technologies and designs are feasible and appropriate in the suggested project area.

1.2.1.3. Training needs assessment to establish what local skills will be required, what skills already exist locally and what skills training will be needed

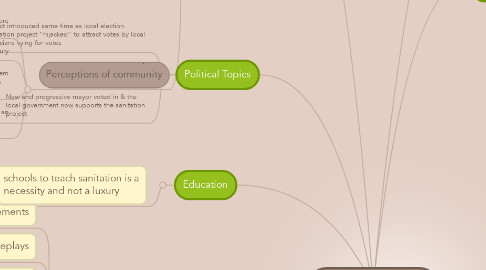

1.3. Perceptions of community

1.3.1. False expectations the loans were “free money”

1.3.2. Sanitation can be seen as a luxury

1.3.3. Educatiion needed on the benefits sanitation system can outweigh their needs in relation to their child’s school fees

1.3.4. Seasonal issues if the client relies on an agricultural means of generating an income.

2. Marketing

2.1. radio advertisements

2.2. dramas and roleplays

2.3. charts distributed – to schools and hospital churches, town council

2.4. * T-shirts given to street cleaners, boda boda cyclists and waitresses in bars to sensitize the men in the community

3. Education

3.1. schools to teach sanitation is a necessity and not a luxury

4. Political Topics

4.1. Project introduced same time as local election. Sanitation project “hijacked” to attract votes by local politicians vying for votes

4.1.1. Lead to mistrust as to the purpose of the loans – politicians espousing money should be given for free as it as donated by the UN

4.2. *

4.3. New and progressive mayor voted in & the local government now supports the sanitation project

4.3.1. Local authorities to install subsidised toilets in schools as well as public locations

5. The Banks and Microfinance

5.1. Do not want to lend for lower profits and high risk

5.2. few have a credit history

5.3. Group strategies

5.3.1. Ones fails to pay consequently each member of the group is responsible.

5.3.1.1. Group members are encouraged to stick together or they those that are still tied in to the agreement are left responsible.

5.3.2. Group has to be of a homogenous environment; as such families should be encouraged to work in such groups.

5.3.3. Men should be involved and act as guarantors, so that they share the same values as the women and are working in unison.

5.3.4. MSF – Multi Stakeholders Forum – met very infrequently, new body set up to raise desired motivation meet more often

5.3.5. Easier to work in groups of 3, one person has access to the loan and the others act as guarantors, if someone leaves then the group can be mobilised to find someone else to join.

5.4. mistrust banks & keep their money “under their pillows"

5.5. not able to reach the poorest of the poor prefer not lending to them as they are too much of a risk.

5.5.1. recommendation 5 people are selected from the poorest of the poor to become artisans as part project workforce, with a salary and a means to better themselves.

6. fundraising

6.1. Another tool that could be considered as an additional source of stream of revenues is Crowdfunding. The implementing partner has to advertise the project on some of the most important crowd funding websites, such as: www.kiva.org, www.indiegogo.com, www.kickstarter.com, www.crowdrise.com.

7. Replication of the Bugembe UN-Habitat Fundraising project

7.1. Sanitation consists mainly of pit latrines, septic tanks, some Ventilated Improved Pit (VIP) latrines and public toilets.

7.2. Microcredit revolving fund project was to fast track sanitation improvement

7.3. Through 900 Female Headed Households (FHHs).

7.4. Implementation partner for UN-Habitat

7.4.1. Revolving micro loans scheme allowed the project to remain sustainable

7.4.1.1. Train women on sanitation and microcredit

7.4.1.2. Revolving loans, to empower local members of the community to construct

7.4.1.3. Improved and affordable facilities

7.4.2. First Bank Ugandan Finance Trust had been appointed as a UN-Habitat imposed means of the funds being released

7.4.2.1. Loans were called in and generated a sense of mistrust in the community.

7.4.2.2. Interest rate of +2.3%, this was perceived by the community as crippling

7.4.3. 2nd Bank Savings and Credit Cooperative Organisation (SACCO)

7.4.3.1. payments may be skipped in favour of other financial pressures, or ventures completely unrelated to sanitation

7.4.3.1.1. man of the house using the money for an alternate business venture

7.4.3.1.2. School fees most common reason

7.4.3.1.3. other loans to pay

7.4.3.2. Interest rate of 1%, were appointed, good community lender

7.4.3.3. 40% of lenders deferring on their loans.

7.4.3.3.1. Legal action taken as last resort to claim the money

7.4.3.3.2. reminders are issued