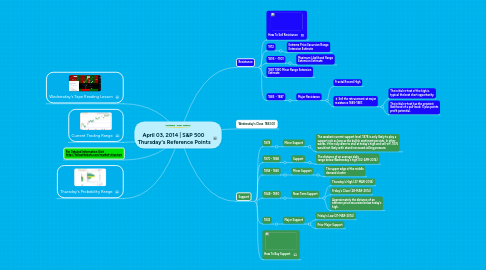

1. Wednesday's Close 1883.00

2. Support

2.1. 1878

2.1.1. Minor Support

2.1.1.1. The weakest current support level. 1878 is only likely to play a support role as long as the bullish sentiment persists. In other words, if the rally were to stall at today’s high and sell-off, 1876 would not likely with stand increased selling pressure.

2.2. 1870 - 1868

2.2.1. Support

2.2.1.1. The distance of an average daily range below Wednesday's high (02-APR-2014)

2.3. 1858 - 1860

2.3.1. Minor Support

2.3.1.1. The upper edge of the middle demand cluster

2.4. 1848 - 1850

2.4.1. Near Term Support

2.4.1.1. Thursday's High (27-MAR-2014)

2.4.1.2. Friday's Close (28-MAR-2014)

2.4.1.3. Approximately the distance of an extreme price excursion below today’s high.

2.5. 1832

2.5.1. Major Support

2.5.1.1. Friday's Low (21-MAR-2014)

2.5.1.2. Prior Major Support

2.6. How To Buy Support

3. Resistance

3.1. How To Sell Resistance

3.2. 1912

3.2.1. Extreme Price Excursion Range Extension Estimate

3.3. 1895 - -1901

3.3.1. Maximum Likelihood Range Extension Estimate

3.4. 1887 1890 Minor Range Extension Estimate

3.5. 1885 - 1887

3.5.1. Major Resistance

3.5.1.1. Fractal Record High

3.5.1.2. Sell the retracement at major resistance 1885-1887.

3.5.1.2.1. The initial re-test of the high is typical the best short opportunity.

3.5.1.2.2. The initial re-test has the greatest likelihood of a pull-back: 5 plus points profit potential.