1. .

1.1. Foreclosure

1.1.1. lender notifies borrower and trustee Notice of Default

1.1.1.1. 3 month Trustee Sale

1.1.1.1.1. Ad once a week for 21 days Notice of Sale

1.1.2. Notice of Default warns owner's of junior liens

1.2. Land contracts

1.2.1. seller retains legal title

1.2.2. vendee = vendor; has equitable title

1.2.3. vendor

1.2.3.1. must use income to make payments against his mortgage

1.2.3.2. cannot use impound accounts

1.2.4. Cal-vet

1.2.4.1. California Veterans Farm and Home Purchase Plan

1.2.4.1.1. financed by Department of Veterans Affairs

1.3. Financing sources

1.3.1. Institutional Lenders

1.3.1.1. Insurance companies

1.3.1.1.1. Use loan correspondents

1.3.1.1.2. do not make construction loans

1.3.1.1.3. prefer long-term loans on existing commercial property

1.3.1.2. Savings bank

1.3.1.2.1. Savings of individual depositories

1.3.1.2.2. Main source of 1- 4 units

1.3.1.2.3. greatest percent of assets in residential property

1.3.1.3. commercial banks

1.3.1.3.1. short term loans

1.3.2. Mortgage Companies

1.3.2.1. Private lenders main source of junior loans

1.3.2.2. originate conventional and sub-prime

1.3.2.3. often lend their own money

1.3.2.4. warehousing

1.3.2.4.1. collection of loans prior to sale

1.3.3. Secondary Mortgage Market

1.3.3.1. FNMA

1.3.3.1.1. buys conventional, VA and FHA loans

1.3.3.2. HUD

1.3.3.2.1. GNMA

1.3.3.3. Freddie Mac works with

1.4. Federal Reserve Board

1.4.1. discount rate

1.4.2. money supply

1.4.2.1. Federal Open Market Committee

1.5. Impound account; benefits

1.5.1. lender

1.5.2. tustor

1.6. miscellaneous

1.6.1. down payment = buyer's equity

1.6.2. more then one buyer

1.6.2.1. lender will include 'jointly and severally'

1.7. FHA

1.7.1. created National Housing Act

1.7.2. enables buyers to by with low-down payment

1.7.3. seller usually pays 1% loan fee

1.7.4. point

1.7.4.1. close the gap between market rates and fixed rates

1.7.4.2. no alienation clause or prepayment penalty is allowed

1.7.4.2.1. alienation = due on sale when transferring ownership

1.7.4.2.2. 'Or more' clause = no prpr-prepayment

1.7.5. MIP or PMI

1.7.6. will loan on a rental property when owner occupied

1.7.7. junior loans are not permitted

1.7.8. lender deciding to originate FHA loans are least concerned with mortgage insurance costs

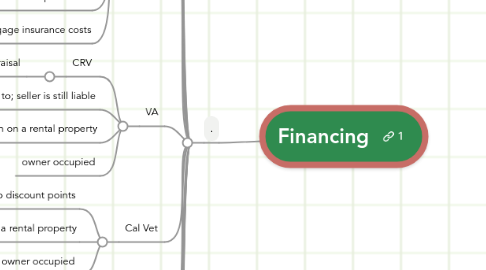

1.8. VA

1.8.1. CRV

1.8.1.1. appraisal

1.8.2. sells home to a non-vet, subject to; seller is still liable

1.8.3. will not loan on a rental property

1.8.4. owner occupied

1.9. Cal Vet

1.9.1. No discount points

1.9.2. will not loan on a rental property

1.9.3. owner occupied

1.10. Blanket Loan

1.10.1. when builder pays to have several lot released his equity in the remain lots increase

1.10.2. property tax cannot be a blanket encumbrance

1.11. AITD

1.11.1. wraparound

1.11.2. used with land contracts

1.11.3. Trust-or in the AITD does not assume existing liens

1.12. Financing Credit Laws

1.12.1. Truth in Lending; Regulation Z

1.12.1.1. all real estate loans not for business

1.12.1.2. APR

1.12.1.2.1. used for comparison shopping

1.12.1.3. Disclosure Statement

1.12.1.3.1. Name of lender

1.12.1.3.2. APR

1.12.1.3.3. Finance charge

1.12.1.4. Ad must disclose APR if interest rate is mentioned

1.12.1.5. rescission

1.12.1.5.1. 3 business days at midnight

1.12.2. RESPA

1.12.2.1. passed in 1974; federal loan disclosure law which helps protect buyers or borrowers who obtain federally related loans

1.12.2.2. reliable way to view costs

1.12.2.2.1. allows client to comparison shop

1.12.2.3. lender requirements

1.12.2.3.1. HUD 'settlement costs' booklet

1.12.2.3.2. Good Faith Estimate

1.12.2.4. kick-backs are illegal

1.12.2.5. limits the amount of impounds

1.12.2.6. seller cannot specify title insurer

1.12.3. Hard Money loan

1.12.3.1. 1st TD

1.12.3.1.1. under 30k are regulated

1.12.3.2. 2nd TD

1.12.3.2.1. under 20k are regulated

1.12.3.3. $8000 due 2years

1.12.3.3.1. max commission is 5%

1.12.3.4. $3,000 due in 3 years

1.12.3.4.1. max. commission is 15%

1.12.4. exclusive loan listing

1.12.4.1. not more the 45

1.12.5. Mortgage loan disclosure Statement

1.12.5.1. must be give within 3 days of broker originated application

1.12.6. Federal; Equal Credit Opportunity

1.12.6.1. everyone is measured against the same stick

1.12.6.2. Penalty

1.12.6.2.1. damages including attorney and court cost

1.12.6.2.2. $5000 in punitive damages Max

1.13. CPI

1.13.1. housing is one of the largest expenses

1.13.2. Rent adjustment

1.13.2.1. commercial leases

1.13.3. pricing index

1.13.3.1. measures the purchasing power of the US dollar

1.14. GDP

1.14.1. when GDP increase then personal income, home sales rise

1.15. Miscellaneous

1.15.1. 'non disturbance-clause = lender will not terminate tenant leases

1.15.2. compensating balances

1.15.2.1. require borrower to maintain a minimum balance

1.15.3. HUD

1.15.3.1. does not need two rails for stairways

1.16. Bankruptcy

1.16.1. discharges debts at date of filing

1.16.2. Gambling debts are dis-chargeable