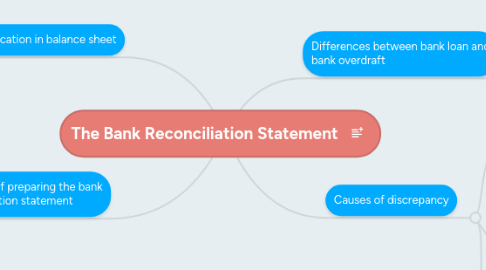

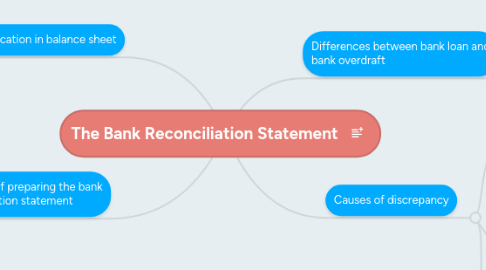

The Bank Reconciliation Statement

by Owen Chua

1. Purpose of preparing the bank reconciliation statement

1.1. Verify the amounts on the bank statement are consistent and compatible with the amounts in the company's Cash account.

2. Classification in balance sheet

2.1. Bank Loan

2.1.1. It is a long term liability

2.2. Bank Accounts

2.2.1. It is a current asset

2.3. Bank Overdrafts

2.3.1. It is a current liability

3. Causes of discrepancy

3.1. Outstanding checks

3.1.1. Checks that have been written and recorded in the company's Cash account, but have not yet cleared by the bank account

3.2. Deposits in transit

3.2.1. Amounts already received and recorded by the company, but are not yet recorded by the bank

3.3. Bank errors

3.3.1. Mistakes made by the bank

4. Differences between bank loan and bank overdraft

4.1. Bank loan

4.1.1. Capital borrowed from the bank and it is a long term liability

4.2. Bank overdraft

4.2.1. Short term borrowing from the bank

4.2.2. Over-drawing made from the bank account