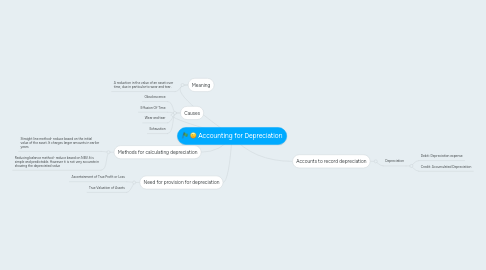

Accounting for Depreciation

by Lik.Y Top

1. Meaning

1.1. A reduction in the value of an asset over time, due in particular to wear and tear.

2. Causes

2.1. Obsolescence

2.2. Effusion Of Time

2.3. Wear and tear

2.4. Exhaustion

3. Need for provision for depreciation

3.1. Ascertainment of True Profit or Loss

3.2. True Valuation of Assets

4. Methods for calculating depreciation

4.1. Straight line method- reduce based on the initial value of the asset. It charges larger amounts in earlier years

4.2. Reducing balance method- reduce based on NBV.It is simple and predictable. However it is not very accurate in showing the depreciated value

5. Accounts to record depreciation

5.1. Depreciation

5.1.1. Debit: Depreciation expense

5.1.2. Credit: Accumulated Depreciation