1. Clay Cty, MO

1.1. 64150

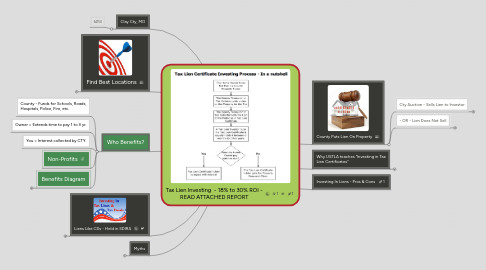

2. Find Best Locations

2.1. 1. Determine Investment Objective

2.1.1. Buy Liens for Interest

2.1.2. Buy Liens To Acquire Homes

2.2. 2. Assess Capital Available

2.2.1. Other People's Money

2.2.2. SDIRA

2.3. 3. Create a Nationwide Strategy to Find County Opportunities

2.3.1. Make List of Markets (Zip codes)

2.3.1.1. Boulder

2.3.1.2. Platte Cty, MO

2.3.1.3. Jackson Cty, MO

2.4. 4. Select CTY - Request Tax Lien List

2.4.1. Liens for Interest:

2.5. 5. Contact Real Estate/Chamber

2.5.1. Highest Value & Best neighborhoods

2.6. 6. Highlight Properties in Best Neighborhoods

2.7. 7. Sort Properties by Price

2.8. 8. Start with Single Family Homes

2.9. 9. Research - Find Most Valuable Homes

2.9.1. Low Crime/Great Schools

2.9.1.1. Google Search

2.9.1.2. Realtor.com

2.9.1.3. Zillow

2.9.1.4. County Records

2.10. 10. Validate Value = Price Sold, Time on Market

2.10.1. Zillow - Past Sales

2.10.2. Trulia - Past Sales

2.10.3. Realtor.com

2.10.4. Talk to Realtor - Is my value accurate?

2.11. 11. I.D. Neighborhoods - Get Chamber Relocation Package

2.12. 12. Go to Lien Auctions or Buy Liens Over-the-counter

3. Who Benefits?

3.1. County - Funds for Schools, Roads, Hospitals, Police, Fire, etc.

3.2. Owner = Extends time to pay 1 to 3 yr.

3.3. You = Interest collected by CTY.

3.4. Non-Profits

3.5. Benefits Diagram

3.5.1. Diagram

4. Liens Like CDs - Held in SDIRA

4.1. Horizon Trust

4.2. IRA Financial Group

5. Myths

5.1. It takes a lot of money

5.2. There are not many "valuable" properties

5.3. Property Owners always owe the IRS money

5.4. There is too much competition

5.5. Requires Real Estate Expertise

5.6. IRS Liens are superior to tax liens

5.7. City & Cty liens are superior -

5.7.1. However special assessments will be do

5.7.2. Some times Special Assessment will be paid on annual taxes

5.8. After Auction Leftover Liens - not good

5.8.1. There can still be great liens that have not been purchased

6. County Puts Lien On Property

6.1. Cty Auction - Sells Lien to Investor

6.1.1. Investor holds 6mo-5yrs

6.1.1.1. 1A: Owner Pays Taxes + Interest

6.1.1.1.1. Investor Repaid + Interest

6.1.1.2. 1B: Owner Does not pay

6.1.1.2.1. Investor Gets Deed

6.1.2. Cty has funds for Services

6.1.3. Owner: More Time to Pay Taxes

6.2. - OR - Lien Does Not Sell

6.2.1. Investor Buys Lien Over-The- Counter

6.2.1.1. 1A: Prop Owner Pays

6.2.1.1.1. Investor = Repaid + Interest

6.2.1.2. 1B:Owner Does not Pay

6.2.1.2.1. See 1B:

6.2.2. Lien Held in CTY Inventory

6.2.2.1. Does Not Sell

6.2.2.1.1. CTY Takes Title

7. Why USTLA teaches "Investing in Tax Lien Certificates"

7.1. 1. It is a service where all participants win.

7.2. 2. Large replenished market - $5 to $7 Bill/yr Tax certificates

7.3. 3. Purpose: Make a positive difference in other's lives

7.4. 4. Most Tax Liens are for rental houses. They have never purchased a property that was "primary" resident.

7.5. 5. If it is a primary residence - you can buy property then sell it back to owner at lower price or rent back and still make money.

7.6. 6. Banks Have Protection: If you do not pay prop tax, they can foreclose. A lien purchaser must give 60 day notice.

7.7. 7. Why wouldn't the bank save property? If they are going to lose the mortgage, they will pay the property taxes to save their collateral asset.

7.8. 7a. Banks - Too many foreclosures & delinquent taxes than ever. More banks failing than ever. Derivatives - who owns the mortgage? = More houses lost to tax liens than ever before.

7.9. 8. Where can I get Tax Lien Lists?

7.9.1. - Contact County

7.9.2. - Go to Office

7.9.3. - Check newspapers for sales

7.9.4. - Paid List Services