Accounting Test Review Notes

by Esther Chun

1. Accounting Equations

1.1. Assets=Liabilities+Owner's Equity

1.1.1. ex. Asset=45,000, Liabilities=25,550, Owner's Equity=?

1.1.2. Solution: 45,000=25,550+? 45,000-25,550=? 19,450=?

1.2. Revenue-Expenses=Net income

1.3. Capital+Net Income=Ending Capital

2. What does Normal Balance mean?

2.1. An Increasing side (Debit or Credit)

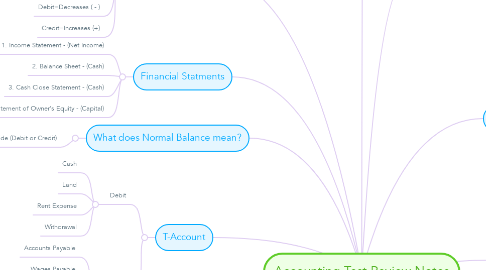

3. T-Account

3.1. Debit

3.1.1. Cash

3.1.2. Land

3.1.3. Rent Expense

3.1.4. Withdrawal

3.2. Credit

3.2.1. Accounts Payable

3.2.2. Wages Payable

3.2.3. Sales

3.2.4. J.Doe, Capital

4. List of Liabilites

4.1. are debits owed to outsiders (creditors)

4.1.1. Wages Payable

4.1.2. Notes Payable

4.1.3. Unearned Revenue

4.1.4. Accounts Payable

4.2. Debit=Decreases ( - )

4.3. Credit=Increases (+)

5. Owner's Equity

5.1. is the owner's right to the assets of business

5.2. Debit=Decreases ( - )

5.3. Credit=Increases (+)

6. Financial Statments

6.1. 1. Income Statement - (Net Income)

6.2. 2. Balance Sheet - (Cash)

6.3. 3. Cash Close Statement - (Cash)

6.4. 4. Statement of Owner's Equity - (Capital)

7. Revenue

7.1. are increases in owner's equity as a result of selling services or products to costumers

7.1.1. Fees Earned

7.1.2. Rent Revenue

7.1.3. Commission Revenue

7.1.4. Interested Revenue

7.2. Debit=Decreases ( - )

7.3. Credit=Increases (+)

8. List of Assets

8.1. Are resources owned by the business entity

8.1.1. Cash

8.1.2. Land

8.1.3. Supplies

8.1.4. Buildings

8.1.5. Accounts Payable

8.1.6. Prepaid Expense

8.2. Debit=Increases (+)

8.3. Credit=Decreases ( - )

9. Expense

9.1. The using up of assets or consuming services in the process of generating revenues results in expenses

9.1.1. Wages Expense

9.1.2. Rent Expenses

9.1.3. Utilities Expenses

9.1.4. Miscellaneous Expense