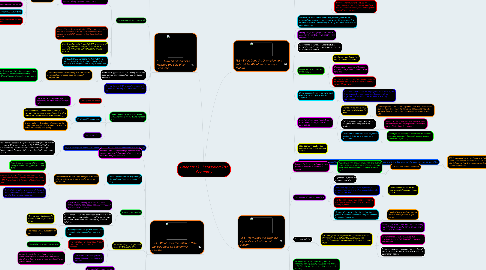

1. 13.2 - How do Economists Measure the Size of an Economy?

1.1. The main measure of the size of the nation's economy is its gross domestic product (GDP).

1.1.1. GDP is an economic indicator that measures a country's total economic output.

1.1.2. Economists also use GDP to compare economies of individual countries.

1.2. Gross Domestic Product (GDP)

1.2.1. Gross Domestic Product (GDP) - the market value of all final goods and services produced within a country during a given period of time.

1.2.1.1. GDP and its limitations

1.2.1.1.1. GDP leaves out unpaid household and volunteer work.

1.2.1.1.2. GDP ignores informal and illegal exchanges.

1.2.1.1.3. GDP counts some negatives as positives.

1.2.1.1.4. GDP ignores negative externalities.

1.2.1.1.5. GDP places no value on leisure time.

1.2.1.1.6. GDP says nothing about income distribution.

1.2.2. Nominal Gross Domestic Product (GDP) - a measure of a country's economic output (GDP) valued in current dollars; nominal GDP does not reflect the effects of inflation.

1.2.3. Real Gross Domestic Product (GDP) - a measure of a country's economic output (GDP) valued in constant dollars; real GDP reflects the effects of inflation.

1.2.4. Per Capita Gross Domestic Product (GDP) - a nation’s real GDP divided by its population; a measure of average economic output per person.

1.3. Economists typically calculate GDP by measuring expenditures on goods and services produced in a country.

1.3.1. Economists divide the economy into four sectors: households, businesses, government, and foreign trade.

1.3.1.1. Each sector’s spending makes up one of the four components of GDP: household consumption (C), business investment (I), government purchases (G), and the net of exports minus imports (NX).

1.4. Economists use GDP to see if an economy is growing or shrinking and what rate it is doing so.

1.5. When the per capita GDP increases, other indicators of well-being increase too.

1.5.1. Literacy and education

1.5.1.1. Literacy Rate - the percentage of people in a country who can read and write.

1.5.2. Health and life expectancy

1.5.2.1. Life Expectancy - the number of years, on average, that a person is expected to live; a key indicator of a nation's health and well-being.

1.5.2.2. Infant Mortality - the rate at which babies die during their first year of life; a key indicator of a nation's health and well-being.

1.5.3. Standard of living

1.6. https://countrydata.bvdep.com/version-2012413/EIU/Help/measuringeconomicactivity.htm

1.6.1. This is a good article because it explains all different types of ways to size the economy. They choose between GDP, GNP and NNP to measure the economy. GNP is the total of incomes earned by residents of a country. They use of these to calculate the economies activity or size.

2. 13.4 - What Does the Inflation Rate Reveal About an Economy's Health?

2.1. Inflation Rate - the percentage increase in the average price level of goods and services from one month or year to the next.

2.2. The BLS tracks inflation by gathering information on Americans; cost of living.

2.2.1. Economists at the BLS track changes in the cost of living using what is known as the consumer price index.

2.2.1.1. Price Index - a measure of the average change in price of a type of good over time.

2.2.1.2. Consumer Price Index (CPI) - a measure of price changes in consumer goods and services over time; the CPI shows changes in the cost of living from year to year.

2.2.1.3. Cost-of-Living Index - a measure of change in the overall cost of goos and services; another term for the onsumer price index.

2.3. Adjusting for Inflation

2.3.1. Nominal Cost of Living - the cost in current dollars of all the basic goods and services needed by the average consumer.

2.3.2. Real Cost of Living - the cost in constant dollars of all the basic goods and services needed by the average consumer; the nominal cost of living adjusted for inflation.

2.3.2.1. The real cost of living can be used to compare prices over time.

2.4. Prices are always changing and these are the results of it.

2.4.1. Creeping Inflation - a gradual, steady rise in the price of goods and services over time.

2.4.1.1. The United States expect this to happen every year.

2.4.2. Hyperinflation - an extreme and rapid rise in the price or goods and services.

2.4.2.1. When inflation goes into overdrive.

2.4.3. Deflation - a fall in the price of goods and services; opposite of inflation

2.4.3.1. A negative of deflation is it can cause a deflationary spiral which can lead to business slowdowns, then to lower wages, then to still lower prices, and so on.

2.5. Causes of Inflation

2.5.1. Increase in the money supply.

2.5.2. Increase in overall demand.

2.5.3. Increase in the cost of the factors of production.

2.6. Costs of Inflation

2.6.1. Loss of purchasing power.

2.6.2. Higher interest rates.

2.6.3. Loss of economic efficiency.

2.7. http://www.investopedia.com/articles/06/gdpinflation.asp?layout=infini&v=2A

2.7.1. This is a god article because it talks about both inflation and GDP. Inflation is the increase in supply or increase in prices. Economists use GDP and inflation to calculate how stable an economy is.

3. 13.3 - What Does the Unemployment Rate Tell Us About an Economy's Health?

3.1. Unemployment Rate - the percentage of the labor force that is not employed but is actively seeking work.

3.1.1. Formula - unemployment rate - number unemployed/number in labor force * 100

3.2. Four Types of Unemployment

3.2.1. Frictional Unemployment - a type of unemployment that results when workers are seeking their first job or have left one job and are seeking another.

3.2.2. Structural Unemployment - a type of unemployment that results when the demand for certain skills declines, often because of changes in technology or increased foreign competition; under such conditions, workers may need retraining to find new jobs.

3.2.3. Seasonal Unemployment - a type of unemployment that results when businesses shut down or slow down for part of the year, often because of weather.

3.2.4. Cyclical Unemployment - a type of unemployment that results from a period of decline in the business cycle; unemployment caused by a contraction.

3.3. Natural Rate of Unemployment - the percentage of the labor force without work when the economy is at full employment; a condition in which the economy is strong and there is no cyclical unemployment.

3.4. Having a high unemployment rate in an economy means the overall health of the economy is poor.

3.5. Each month, the ureau of Labor Statistics reports the total number of unemployed people of the previous month.

3.6. People are categorized into three groups.

3.6.1. Employed - members of the labor force who have jobs.

3.6.2. Unemployed - members of the labor force who are jobless, but are looking for work.

3.6.3. Not in the Labor Force - Everyone who eligible to be in the labor force but is neither working now looking for work.

3.7. Some people will always be out o work, even in an economy that has full employment.

3.7.1. If an economy reaches full employment then there is jobs fro everyone, but some people and jobs do not go together. Everyone has different skills or learning experiences.

3.8. Results that can make the BLS not so exact on hwo many people are unemployed.

3.8.1. Unemployed workers could have given up in looking for work.

3.8.1.1. Discouraged Workers - unemployed workers who have ceasd to look for work; discouraged workers are not considered part of the labor force and are not factored into the unemployment rate.

3.8.2. Official unemployment rate does not recognize involuntary part-time workers.

3.8.2.1. Involuntary Part-Time Workers - people who settle for part-time employment because they are unable to find full-time work.

3.8.3. The unemployment rate involves people working in informal or underground economies.

3.8.3.1. Underground Economy - a sector of the economy based on illegal activities, such as drug dealing and unlawful gambling.

3.9. Main economic cost of high unemployment is lost potential output.

3.10. http://www.slate.com/articles/business/the_edgy_optimist/2014/03/how_much_does_the_unemployment_rate_tell_us_about_the_economy_not_as_much.html

3.10.1. This is a good article to use because it talks about the Bureau of Labor Statistics and how they calculate the unemployment rate. It also talks about how the unemployment rate is increasing every year or even month.

4. 13.5 - How Does the Business Cycle Relate to Economic Health?

4.1. Business Cycle - a recurring pattern of growth and decline in economic activity.

4.1.1. Popularly known as periods of boom and bust. A boom is the expansion phase of the cycle and a bust is the contraction phase of the business cycle.

4.1.1.1. A bust is also called a recession.

4.2. Four Phases of the Business Cycle

4.2.1. Expansion - a period of economic growth.

4.2.2. Peak - the highest point of an expansion, or period of economic growth; a peak is followed by economic decline.

4.2.2.1. You don't know if you hit the very top until things start to get worse.

4.2.3. Contraction - a period of general economic decline marked by falling GDP and rising unemployment.

4.2.4. Trough - the lowest point of a contraction, or period of economic decline; a trough is followed by economic growth.

4.2.4.1. You don't know you have hit rock bottom till things start to get better.

4.3. Economic indiators

4.3.1. Business cycles are irregular in length and severity, so this makes it more difficult to predict peaks and troughs. Economists use economic indicators to predict them.

4.3.1.1. Leading Indicators - measures that consistently rise or fall several months before an expansion or a contraction begins.

4.3.1.2. Coincident Indicators - measures that consistently rise or fall along with expansions or contractions.

4.3.1.3. Lagging Indicators - measures that consistently rise or fall severall months after an expansion or contraction begins.

4.4. Recession - a period of declining national economic activity, usually measured as a decrease in GDP for at least two consecutive quarters (six months).

4.5. Depression - a prolonged economic downturn characterized by plunging real GDP and extremely high unemployment.

4.6. http://www.frbsf.org/education/publications/doctor-econ/2002/may/business-cycles-economy

4.6.1. This article is good because it explains what business cycles are and what they mean. It claims that business cycles are the "ups and downs" of economic activity. It states that the National Bureau of Economic Research (NBER) has designated nine business cycles over the years from 1945 to 1991. It also states that in November 2001, the U.S. economy reached a peak in March of 2001, and it designated that month as the beginning of a recession.