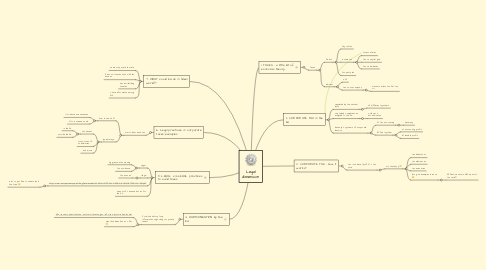

1. 4. HARMONISATION by the EU

1.1. from the history (only information regarding corporate taxes)

1.1.1. http://ec.europa.eu/taxation_customs/taxation/gen_info/tax_policy/index_en.htm

1.1.2. what has been done so far ;)

2. 5. LEGAL x ILLEGAL practices to avoid taxes

2.1. Legal:

2.1.1. Aggressive tax planing

2.1.2. Tax avoidance

2.2. Illegal

2.2.1. Tax evasion

2.3. http://www.europarl.europa.eu/RegData/etudes/STUD/2015/558773/EPRS_STU(2015)558773_EN.pdf

2.3.1. intro is just fine to understand the topic ;)

2.4. amount of revenue losses for the EU

3. 6. Legal practices in corporate taxes; examples

3.1. aim: to decrease tax

3.1.1. how to reach it?

3.1.1.1. 1) to decrease revenues

3.1.1.2. 2) to increase costs

3.1.2. typical ways:

3.1.2.1. tax havens

3.1.2.1.1. in the EU

3.1.2.1.2. outside the EU

3.1.2.2. structures of subsidiaries

3.1.2.3. ...and more

4. 7. WHAT could EU do in (ideal world)?

4.1. same corporate tax rate

4.2. ficus on transactions with tax havens

4.3. more witholding taxation

4.4. share information among MS

5. 1. TAXES - a little bit of economic theory

5.1. Taxes

5.1.1. Direct

5.1.1.1. Payroll tax

5.1.1.2. Income tax

5.1.1.2.1. Corporate tax

5.1.1.2.2. Tax on capital gain

5.1.1.2.3. Tax on dividends

5.1.1.3. Property tax

5.1.2. Indirect

5.1.2.1. VAT

5.1.2.2. tax on consumption

5.1.2.2.1. alcohol, carbon tax, fat tax, oil...

6. 2. CORPORATE TAX in the EU

6.1. regulated by the national laws

6.1.1. 29 different systems

6.2. only limited competences assigned to the EU

6.2.1. calls upon harmonisation

6.3. basically 2 systems of corporate taxation

6.3.1. A) Tax accounting

6.3.1.1. Germany

6.3.2. B) Dual system

6.3.2.1. a) accounting profit

6.3.2.2. b) taxable profit

7. 3. CORPORATE TAX - how it works?

7.1. tax = tax base (profit) x tax rate

7.1.1. not that easy :)

7.1.1.1. tax deductions

7.1.1.2. tax allowences

7.1.1.3. tax incentives

7.1.1.4. lets give examples to each ;)

7.1.1.4.1. Effective rate is NOT equal to tax rate!!!