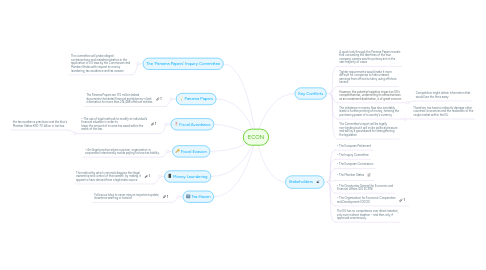

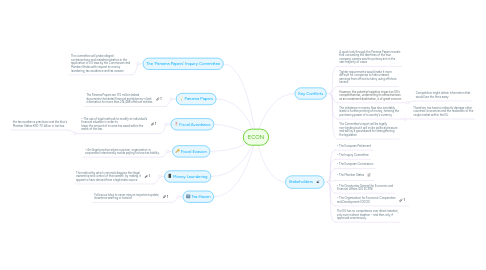

ECON

par Livia Hoxha

1. Panama Papers

1.1. The Panama Papers are 11.5 million leaked documents that detail financial and attorney–client information for more than 214,488 offshore entities

2. Fiscal Avoidance

2.1. – The use of legal methods to modify an individual’s financial situation in order to lower the amount of income tax owed within the ambit of the law.

2.1.1. the tax avoidance practices cost the bloc’s Member States €50-70 billion in lost tax.

3. Fiscal Evasion

3.1. – An illegal practice where a person, organization or corporation intentionally avoids paying his true tax liability.

4. Money Laundering

4.1. The method by which criminals disguise the illegal ownership and control of their wealth, by making it appear to have derived from a legitimate source

5. Tax Haven

5.1. Follow our blog to never miss an important update, downtime warning or tutorial!

6. The 'Panama Papers' Inquiry Committee

6.1. The committee will probe alleged contraventions and maladministration in the application of EU laws by the Commission and Member States with respect to money laundering, tax avoidance and tax evasion

7. Stakeholders

7.1. • The European Parliament

7.2. • The Inquiry Committee

7.3. • The European Commission

7.4. • The Member States

7.5. • The Directorate General for Economic and Financial Affairs (DG ECFIN)

7.6. • The Organization for Economic Cooperation and Development (OECD)

7.7. The EU has no competence over direct taxation, only over indirect taxation – and then only if approved unanimously.

8. Key Conflicts

8.1. A quick look through the Panama Papers reveals that concealing the identities of the true company owners was the primary aim in the vast majority of cases

8.2. Tighter requirements would make it more difficult for companies to hide untaxed earnings from official scrutiny using offshore havens.

8.3. However, the potential negative impact on EU’s competitiveness, undermining its attractiveness as an investment destination, is of great concern

8.3.1. Competitors might obtain information that would lure the firms away

8.4. The imbalance in money flow also inevitably leads to further printing of money, harming the purchasing power of a country’s currency

8.4.1. Therefore, tax havens indirectly damage other countries’ economies and the realization of the single market within the EU.