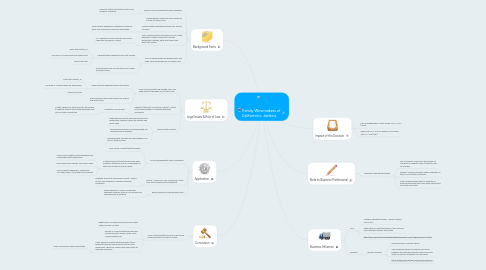

1. Background Facts

1.1. Twenty-first Amendment ended Prohibition

1.1.1. Gave the states substantial control over alcoholic regulation

1.2. Massachusetts used three-tier system to control alcoholic sales

1.3. Massachusetts adjusted the three-tier system for wine

1.3.1. Allows direct shipping to consumers as well as three-tier system for economic advantages

1.4. 2005 Massachusetts law allowed only in-state wineries to obtain licenses to combine distribution method, both direct sales and three-tier system

1.4.1. U.S. Supreme Court found this law invalid under the Commerce Clause

1.5. 2006 Massachusetts law divided small and large wineries through 30,000 gallon cap

1.5.1. Large wineries shipping license can choose

1.5.1.1. Three-tire system, or

1.5.1.2. Sell wine in MA exclusively by direct sales

1.5.1.3. Cannot do both

1.5.2. Small wineries can do both three-tier system and direct sales

2. Legal Issues & Rule of Law

2.1. 2006 Massachusetts law divided small and large wineries through 30,000 gallon cap

2.1.1. Large wineries shipping license can choose

2.1.1.1. Three-tier system, or

2.1.1.2. Sell wine in MA exclusively by direct sales

2.1.1.3. Cannot do both

2.1.2. Small wineries can do both three-tier system and direct sales

2.2. Negative (Dormant Commerce Clause) – states do not have powder to regulate interstate commerce

2.2.1. Protection of Economy

2.2.1.1. A state cannot bar the goods into its borders in order to protect its in-state industries from out-of-state competition

2.3. Discriminatory effect

2.3.1. Large wineries cannot have benefits of both distribution methods: three-tier system and direct sales.

2.3.2. All wineries produced in Massachusetts are considered small wineries

2.3.3. Massachusetts wineries have advantages over out-of-state wineries

3. Application

3.1. 2006 Massachusetts law is unjustified

3.1.1. Only favors in-state (small) wineries

3.1.2. In-state wineries (small) wineries can have maximum efficiency due to combination of three-tier system and direct sales.

3.1.2.1. Can produce higher volume depending on relationships with wholesalers

3.1.2.2. Can acquire new markets from direct sales

3.1.2.3. Can use direct shipping to consumers "no middle man". Can target more markets

3.2. Article 1, Section 8: The Commerce Clause (can be both positive and negative)

3.2.1. Negative (Dormant Commerce Clause) – states do not have powder to regulate interstate commerce

3.3. Equal Protection: Rational Basis Test

3.3.1. Raises question if 2006 MA law have legitimate purpose since all MA wineries are considered small wineries.

4. Conclusion

4.1. 2006 Massachusetts law should be invalid under Dormant Commerce Clause

4.1.1. 98percent of all wine produced in the United States are out-of-state

4.1.2. Almost all Massachusetts wineries are considered small winery under 2006 Massachusetts Law

4.1.3. It only benefits Massachusetts wineries (small wineries) because they have benefits of both distribution: three-tier system and direct sales to maximize efficiency

4.1.3.1. Does not practice equal opportunity

5. Impact of the Decision

5.1. City of Philadelphia v. New Jersey 437 U.S. 617 (1978)

5.2. Dean Milk Co. v. City of Madison, Wisconsin, 340 U.S. 349 (1951)

6. Note to Business Professional

6.1. Regulation and transportation

6.1.1. The Commerce Clause can give power to Congress to regulate state, intrastate, and local affairs

6.1.2. Federal/ congress override state’s regulation in terms of intrastate commerce

6.1.3. Gives Congress the power to regulate all business activities that cross state lines/affect more than one state

7. Business Influence

7.1. UPS

7.1.1. Created "operating center", "feeder system", "hubs",etc...

7.1.2. depending on route/destination, the company uses different tractors and trailers

7.1.3. http://law.justia.com/cases/washington/supreme-court/1984/50494-6-1.html

7.2. Amazon

7.2.1. Amazon tax laws

7.2.1.1. impose duties on remote sellers

7.2.1.2. "each requires there be some type of nexus between the state and remote seller before the state can impose obligations on the seller"

7.2.1.3. https://www.fas.org/sgp/crs/misc/R42629.pdf