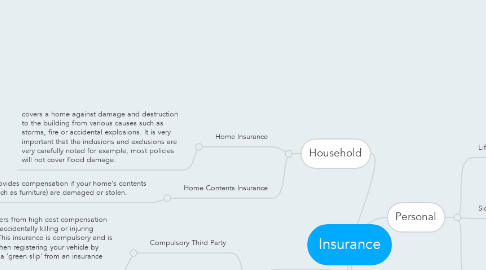

1. Household

1.1. Home Insurance

1.1.1. covers a home against damage and destruction to the building from various causes such as storms, fire or accidental explosions. It is very important that the inclusions and exclusions are very carefully noted for example, most policies will not cover flood damage.

1.2. Home Contents Insurance

1.2.1. provides compensation if your home's contents (such as furniture) are damaged or stolen.

2. Motor Vehicle

2.1. Compulsory Third Party

2.1.1. Insures drivers from high cost compensation involved in accidentally killing or injuring someone. This insurance is compulsory and is obtained when registering your vehicle by purchasing a 'green slip' from an insurance company.

2.2. Third Party Property

2.2.1. this covers the same as compulsory third party, but also any third party property damage that may occur.

2.3. Comprehensive Motor Vehicle Insurance

2.3.1. this covers the cost of repairs or sometimes the replacement of your vehicle and any other vehicles involved in an accident.

3. Personal

3.1. Life Insurance

3.1.1. the most common form of life insurance. This policy covers a person for a set time. If the person dies within this time span, the insurance company will pay a specified amount to the next kin or other nominated person.

3.2. Sickness and Accident Insurance

3.2.1. usually taken out by self-employed people who are not covered by workers' compensation and do not receive pay for sick leave. It provides cover if a person cannot work and thus receive their normal income.

3.3. Health Insurance

3.3.1. in Australia, everyone is covered for basic medical costs by a government health insurance scheme called Medicare. However, if people wish, they may take out additional private health insurance cover to provide special benefits, such as orthodontic expenses.