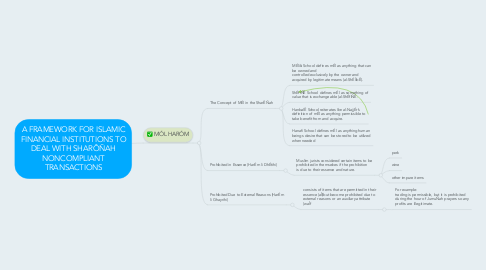

1. MÓL HARÓM

1.1. The Concept of MÉl in the SharÊÑah

1.1.1. MÉliki School defines mÉl as anything that can be owned and controlled exclusively by the owner and acquired by legitimate means (al-ShÉÏibÊ).

1.1.2. ShÉfiÑÊ School defines mÉl as something of value that is exchangeable (al-ShÉfiÑÊ.

1.1.3. HanbalÊ School reiterates Ibn al-NajjÉr’s definition of mÉl as anything permissible to take benefit from and acquire.

1.1.4. Hanafi School defines mÉl as anything human beings desire that can be stored to be utilized when needed

1.2. Prohibited in Essence (HarÉm li DhÉtihi)

1.2.1. Muslim jurists considered certain items to be prohibited in themselves if the prohibition is due to their essence and nature.

1.2.1.1. pork

1.2.1.2. wine

1.2.1.3. other impure items

1.3. Prohibited Due to External Reasons (HarÉm li Ghayrihi)

1.3.1. consists of items that are permitted in their essence (aÎl)but become prohibited due to external reasons or an auxiliary attribute (waÎf

1.3.1.1. For example: trading is permissible, but it is prohibited during the hour of JumuÑah prayers so any profits are illegitimate.