1. Conclusion

1.1. ..

1.2. Appellate decision held. Plaintiff granted equitable interest measured by the value of half of the entire lease.

1.2.1. Judgement modified to include trust option and costs. Reduced Meinhard's share to 49% "to preserve to the defendant Salmon the expected measure of dominion."

1.3. ANDREWS, J. (dissenting). No general partnership, merely a joint venture for a specific project with a specified termination.

1.3.1. Mr. Salmon's transaction was completed in good faith, without collusion, under his sole enterprise, for his individual benefit.

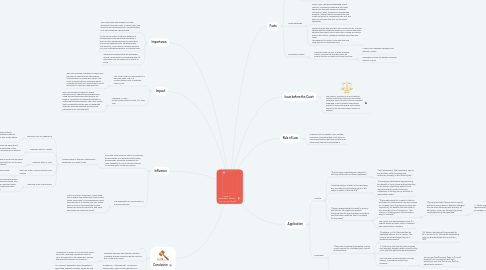

2. Impact

2.1. LSP INVESTMENT PARTNERSHIP v BENNETT989 F.2d 779 United States Court of Appeals, Fifth Circuit

2.1.1. This case involved a situation in which one member of a partnership was seeking compensation for bankrupcy issues. The court affirmed that the managing parter forfieted his rights to compensation due to his breach of fiduciary reponsibilities.

2.2. Lawrence v. Cohn United States District Court, S.D. New York.

2.2.1. This case involved a lawsuit in which beneficiaries of a general partnership were suing the remaining executive partner for fraud in connection to making purchases of limited partnership interests. The court found that the executive parter was not obligated under his fiduciary capacity to inform the beneficiaries of such interests.

3. Importance

3.1. The courts hold partnerships to a high standard of fiduciary duty. In some cases, the structure and transactions of "coadventurers" may be considered a partnership.

3.2. It may be necessary to choose between a partnership and an individual enterprise if there is not a transparent way to keep them as sole and separate from the partnership. Not doing so could result in residual benefits to a non-contributing partner or coadventurer.

3.3. Individual business interests developed during a partnership and solidified after its expiration may be viewed as an intent to fraud.

4. Influence

4.1. From this case came the notion of Fiduciary Responisiblity as a separate entity within partnerships. Generally speaking it is a legal obligation to act in the best interest of another party as well as yourself.

4.1.1. Multiple areas of fiduciary duities have developed as a result of this.

4.1.1.1. Fiduciary Duty of Obedience

4.1.1.1.1. Associates are to fulfill their duties in correspondence to delegeated authority within the partnership as well as any legally governing documents.

4.1.1.2. Fiduciary Duty of Loyalty

4.1.1.2.1. Pertners and associates are expected to devote loyalty to the wellbeing of the shares business above personal or external interests.

4.1.1.3. Fiduciary Duty of Care

4.1.1.3.1. Decisions made in good faith and with reasonable care that turn out to harm corporate interests.

4.1.1.4. Fiduciary Duty of Good Faith and Fair Dealing

4.1.1.4.1. Daily practices are done so with honesty and fairness.

4.1.1.5. Fiduciary Duty of Disclosure

4.1.1.5.1. Open honesty between associates allows for loyalty, informed decisionmaking, and fact sharing. Especially important when induviduals must make decscions and business transactions.

4.2. The application of "Good Faith" in business dealings.

4.2.1. Many courts will implement a "goof faith" test in which they determine if the trustee acted 'reasonably' in correspondence with the interests of all parties involved. Cases that courts will implement this involve themes of abuse of discretion, bad faith, dishonesty and arbitrary action.

5. Facts

5.1. Paties

5.1.1. Morton H. Meinhard, Plaintiff

5.1.2. Walter J. Salmon et al., Defendants

5.2. What happened

5.2.1. Salmon and Meinhard established a joint venture. Meinhard invested half the funds needed for the joint venture in order to reconstruct, alter, manage and operate the property. Salmon agreed to distribute 40% of the net profit to Meinhard for the first five years of the lease and 50% for the years thereafter.

5.2.2. When the lease had less than four months to run, Salmon agreed with the property owner on a lucrative new lease between the owner and a corporation owned by Salmon. Salmon did not tell Meinhard anything about the new lease. Meinhard got to know it only after the new lease was an accomplished fact.

5.3. Procedural History

5.3.1. Mainhard sued Salmon and the property owner, claiming the the new lease "be held in trust as an asset of the joint venture"

5.3.1.1. Lower court awarded Meinhard 25% interest in lease

5.3.1.2. Appellate Division increased Meinhard’s interest to 50%

6. Issue before the Court

6.1. Did Salmon, a partner in a joint venture, violate his fiduciary duties to his partner, Meinhard, when he didn't inform Meinhard regarding a new business opportunity related to their partnership and instead contracts for the new benefit solely for himself?

7. Rule of Law

7.1. Owing a duty of loyalty to one another, members of a partnership must disclose new opportunities that arise so that both have equal chance to pursue them.

8. Application

8.1. Plaintiff

8.1.1. “The two were coadventurers, subject to fiduciary duties akin to those of partners.”

8.1.1.1. “Joint adventurers, like copartners, owe to one another, while the enterprise continues, the duty of the finest loyalty.”

8.1.2. “Here the subject-matter of the new lease was an extension and enlargement of the subject-matter of the old one."

8.1.2.1. "A managing coadventurer appropriating the benefit of such a lease without warning to his partner might fairly expect to be reproached with conduct that was underhand, or lacking, to say the least, in reasonable candor."

8.1.3. “Salmon appropriated to himself in secrecy and silence. He might have warned Meinhard that the plan had been submitted, and that either would be free to compete for the award."

8.1.3.1. “The trouble about his conduct is that he excluded his coadventurer from any chance to compete, from any chance to enjoy the opportunity for benefit that had come to him alone by virtue of his agency. This chance, if nothing more, he was under a duty to concede.”

8.1.3.1.1. “The very fact that Salmon was in control with exclusive powers of direction charged him the more obviously with the duty of disclosure, since only through disclosure could opportunity be equalized.”

8.1.3.2. The owner may have extended lease (i.e., original Bristol property only) if Meinhard had opportunity to weigh in.

8.2. Defendant

8.2.1. “There was no general partnership, merely a joint venture for a limited object, to end at a fixed time.”

8.2.1.1. "Doubtless in it Mr. Meinhard had an equitable interest, but in it alone. This interest terminated when the joint adventure terminated."

8.2.1.1.1. "Mr. Salmon has done all he promised to do in return for Mr. Meinhard’s undertaking when he distributed profits up to May 1, 1922.”

8.2.1.2. “[...] the mere fact that the joint ventures rent property together does not call for the strict rule that applies to general partners.”

8.2.1.3. The new lease differed greatly from the original, "something distinct and different."

8.2.1.3.1. Annual rent (not $55K but $350 to $475K); duration (not 20 years but 80); and alterations cost (not $200K but $3M) all significantly different.

8.2.2. “The issue is whether actual fraud, dishonesty, unfairness is present in the transaction.”

8.2.2.1. Salmon had no conscious purpose to defraud. He assumed in good faith that with imminent end of venture he had no obligation to loop in Meinhard