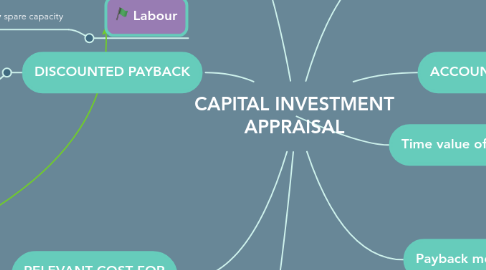

1. Labour

1.1. Q1 Is there any spare capacity

1.1.1. Yes

1.1.1.1. Relevant cost zero

1.1.2. No

1.1.2.1. Q2 Can they be hire from outside

1.1.2.1.1. Yes

1.1.2.1.2. No

2. Mate Rial

2.1. Q1 is material in stock

2.1.1. Yes

2.1.1.1. Q2 It is regularly used

2.1.1.1.1. Yeas

2.1.1.1.2. no

2.1.2. No

2.1.2.1. Relevant costs current purchase cost

3. DISCOUNTED PAYBACK

3.1. Similar to simple payback

3.1.1. Advantages

3.1.1.1. Take a long time to achieve

3.1.1.2. A crude way of allocating money

3.1.1.3. Easy

3.1.1.4. Prevents any project

3.1.2. Disadvantages

3.1.2.1. Choice of a maximum

3.1.2.2. Ignores the size

4. NPV

4.1. The timing of cash flows

4.1.1. A cash outlay at the beginning of an investment project occurs

4.1.2. A cash flow that occurs during the course of year is assumed to occur

4.1.3. If it, it is assumed that the cash flow happens at the beginning of the previous year

4.2. Investment in working capital

4.2.1. Working capital should be considered to consist of investments in inventory and receivables, minus trade payables

5. RELEVANT COST FOR DECISION MAKING

5.1. Relevant cost

5.1.1. Avoidable cost

5.1.2. Differential cost

5.1.3. Opportunity cost

5.1.4. Attributable fixed cost

5.2. Irrelevant cost

5.2.1. Fixed cost

5.2.2. Depreciation & Committed cost

5.2.3. Historic cost of asset

5.2.4. interest cost

6. ARR

6.1. ARR=Average annual profits/Initial capital costs

6.1.1. Advantages

6.1.1.1. Simplicity

6.1.1.2. Widely use

6.1.1.3. Link

6.1.2. Disadvantages

6.1.2.1. Fail to take account

6.1.2.2. Ignores cash flows

7. ACCOUNTING RATE OF RETURN

7.1. It is same like ROCE

7.1.1. ARR=(Average annual profit/Initial capital costs)*100%

7.1.1.1. Advantages

7.1.1.1.1. Simplicity

7.1.1.1.2. Widely use

7.1.1.1.3. Link

7.1.1.2. Disadvantages

7.1.1.2.1. Fail to take account

7.1.1.2.2. Ignore cash flow

8. Time value of money

8.1. Investment opportunity

8.2. Inflation

8.3. Risk

9. IRR

9.1. IRR=A+[a/(a-b)x(B-A)]

9.1.1. Advantages

9.1.1.1. Into account the time value of money

9.1.1.2. Result

9.1.1.3. how sensitive decisions are to a change in interest rates

9.1.2. Disadvantages

9.1.2.1. Confusing

9.1.2.2. Give conflicting recommendations to NPV

9.1.2.3. Unfamiliar

9.1.2.4. Changes in interest rates

10. Payback method of appraisal

10.1. Take for cash inflows from CI

10.1.1. Payback prriod=Initial payment/Annual cash inflow

10.1.1.1. Advantages

10.1.1.1.1. Simplicity

10.1.1.1.2. Widely use

10.1.1.1.3. Tend to minimise the effects of risk

10.1.1.2. Disadvantages

10.1.1.2.1. Cash flows arising the payback

10.1.1.2.2. Ignore time value of money

10.1.1.2.3. don't take to account

10.1.1.2.4. Difficult to set a target