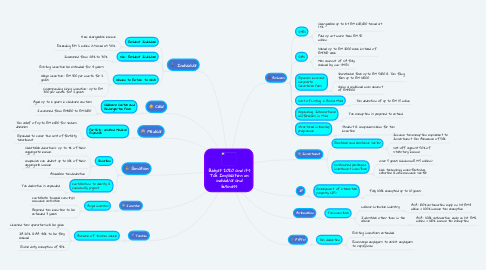

1. Tourism

1.1. Purchase of tourism vehicle

1.1.1. Licensed tour operators will be given

1.1.2. IA 20% & AA 40% to be fully claimed

1.1.3. Excise duty exemption of 50%

2. Investor

2.1. Angel investor

2.1.1. contribute toward country's economic activities

2.1.2. Proposed tax incentive to be extended 3 years

3. Individual

3.1. Resident Individual

3.1.1. New chargeable income

3.1.2. Exceeding RM 2 million is taxed at 30%

3.2. Non- Resident Individual

3.2.1. Increased from 28% to 30%

3.3. Women to Return to Work

3.3.1. Existing incentive be extended for 4 years

3.3.2. Wage incentive- RM 500 per month for 2 years

3.3.3. Corresponding hiring incentive- up to RM 300 per month for 2 years

4. Child

4.1. Childcare Centre and Kindergarten Fees

4.1.1. Aged up to 6 years in childcare centres

4.1.2. Increased from RM1000 to RM2000

5. Donation

5.1. Donation

5.1.1. Charitable donations- up to 7% of their aggregate income.

5.1.2. companies can deduct up to 10% of their aggregate income

5.1.3. Allowable tax deduction

5.2. contribution to charity & community project

5.2.1. Tax deduction is expanded

6. Medical

6.1. Fertility- related Medical Expenses

6.1.1. Tax relief of up to RM 6000 for serious diseases

6.1.2. Expanded to cover the cost of fertility treatment

7. Business

7.1. SMEs

7.1.1. Chargeable up to 1st RM 600,000 taxed at 17%

7.1.2. Paid up not more than RM 50 million

7.2. SVAs

7.2.1. Valued up to RM 2000 each instead of RM1300 each

7.2.2. Max amount of CA fully claimed by non-SMEs

7.3. Expenses incurred- Corporate Secretarial Fees

7.3.1. Secretarial fees up to RM 5000 & Tax filing fees up to RM 10000

7.3.2. Claim a combined max amount of RM15000

7.4. Cost of Listing in Bursa M'sia

7.4.1. Tax deduction of up to RM 1.5 milion

7.5. Organizing International conferences in M'sia

7.5.1. Tax exemption is proposed to extend

7.6. structured internship programme

7.6.1. Student & companies claim for tax incentive

8. IP

8.1. Development of intellectual property (IP)

8.1.1. fully 100% exempted up to 10 years.

9. PTPTN

9.1. Tax deduction

9.1.1. Existing incentives extended.

9.1.2. Encourage employers to assist employees to repay loan.

10. Investment

10.1. Electrical and electronic sector

10.1.1. Income tax exemption equivalent to Investment Tax Allowance of 50%

10.1.2. set-off against 50% of statutory income

10.2. Customised packaged investment incentives

10.2.1. over 5 years (minimum RM 5 million)

10.2.2. high technology, manufacturing, creative & new economic sector

11. Automation

11.1. Tax incentives

11.1.1. Labour-intensive industry

11.1.1.1. ACA- 100% automation equip on 1st RM4 million + 100% income tax exemption

11.1.2. Industries other than in the above

11.1.2.1. ACA- 100% automation equip on 1st RM2 million + 100% income tax exemption