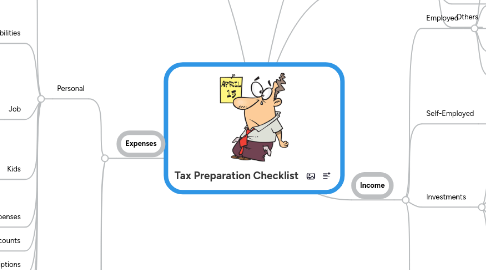

1. Expenses

1.1. Personal

1.1.1. Homeowner/Renter

1.1.1.1. Mortgage interest

1.1.1.2. Real estate taxes paid

1.1.1.3. Rent paid during tax year

1.1.1.4. Sale of your home or other real estate

1.1.1.5. Moving expenses

1.1.2. Financial liabilities

1.1.2.1. Auto loans and leases

1.1.2.2. Student loan interest paid

1.1.2.3. Early withdrawal penalties on CDs and other time deposits

1.1.2.4. Personal property tax for car

1.1.3. Job

1.1.3.1. Job-hunting expenses

1.1.3.2. Job-related education expenses

1.1.4. Kids

1.1.4.1. Child care expenses

1.1.4.2. Alimony paid

1.1.4.3. Adoption expenses

1.1.5. Investment expenses

1.1.6. Medical Savings Accounts

1.1.7. Dues, subscriptions

1.1.8. Gifts to charity

1.1.9. Other expenses

1.2. Self-Employed

1.2.1. Schedule C

1.2.2. Other expenses (Statement 1)

1.2.3. Use database or finance program to track business income and expenses

1.3. Other expenses

1.3.1. Tax return preparation expenses and fees

2. Other notes

2.1. Accountant

2.2. To do

3. Personal Data

3.1. Social Security Numbers

3.2. Business IEN

4. Miscellaneous Tax Documents

4.1. Retirement plan contributions

4.2. Records to document medical expenses

4.3. Records to document casualty or theft losses

4.4. Records for any other expenditures that may be deductible

4.5. Others

5. Income

5.1. Employed

5.1.1. W-2 forms

5.1.2. Unemployment compensation

5.1.3. Jury duty pay

5.1.4. Pensions and annuities

5.1.5. Social security benefits

5.2. Self-Employed

5.2.1. Business income

5.2.2. Partnership income

5.2.3. Other business income

5.3. Investments

5.3.1. Dividend income

5.3.2. Proceeds from broker transactions

5.3.3. Retirement plan distribution

5.3.4. Other income from investments

5.4. Other income

5.4.1. Alimony received

5.4.2. Rent income

5.4.3. State and local income tax refunds

5.4.4. Scholarships and fellowships

5.4.5. Prizes and awards

5.4.6. Gambling and lottery winnings

5.4.7. Other miscellaneous income